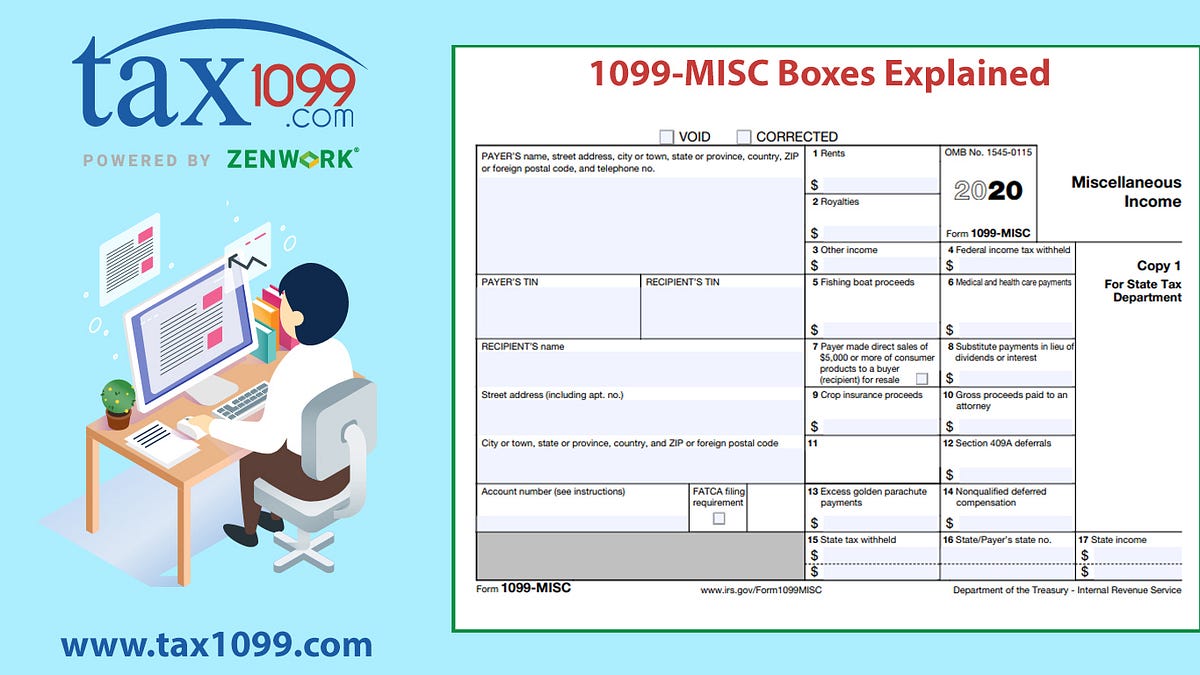

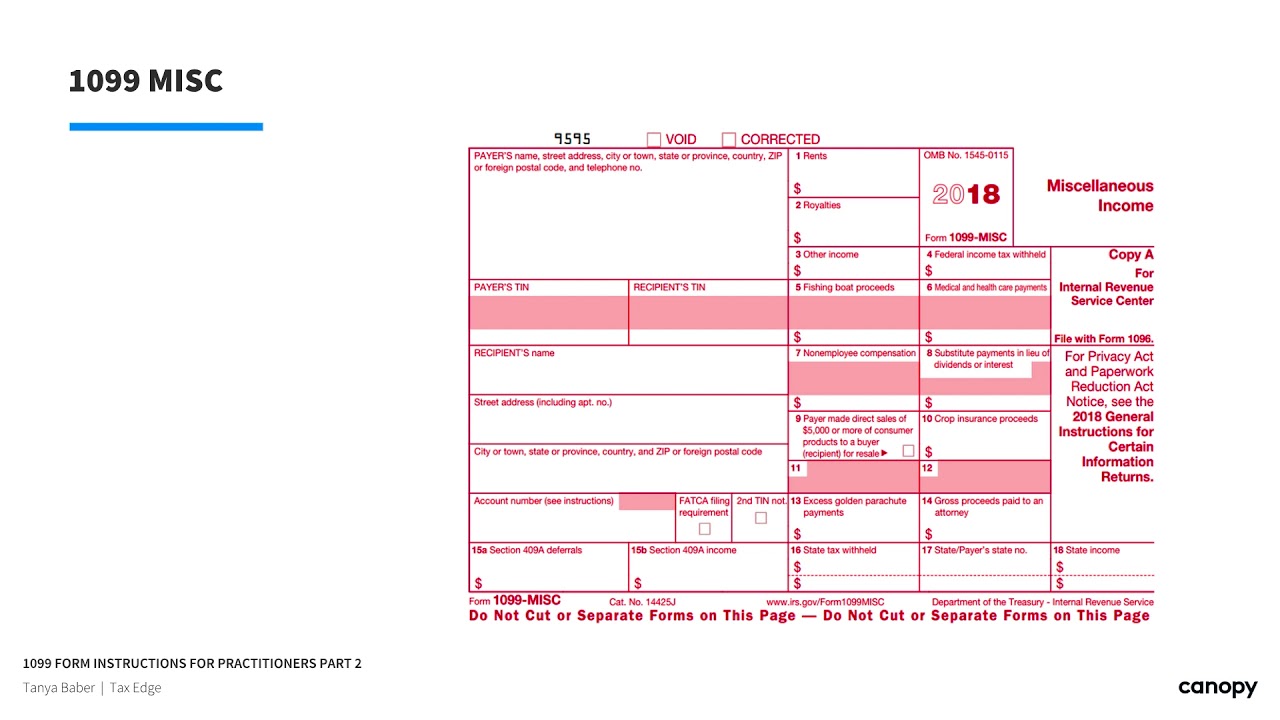

Form 1099MISC 19 Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 19 General Instructions for Certain Information Returns 9595 VOID CORRECTED Form 1099 NEC & Independent Contractors Question What's the difference between a Form W2 and a Form 1099MISC or Form 1099NEC? > Irs 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors by Role Advertisement Advertisement 21 Gallery of Irs 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors 1099 Form For Independent Contractors Workers Compensation Waiver Form For Independent Contractors

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What 1099 form for independent contractor

What 1099 form for independent contractor-1099 form independent contractor 21 Fill out forms electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out Save files on your laptop or mobile device Boost your productivity with effective solution?Here you need to withhold your own taxes Having said that the independent contractor is

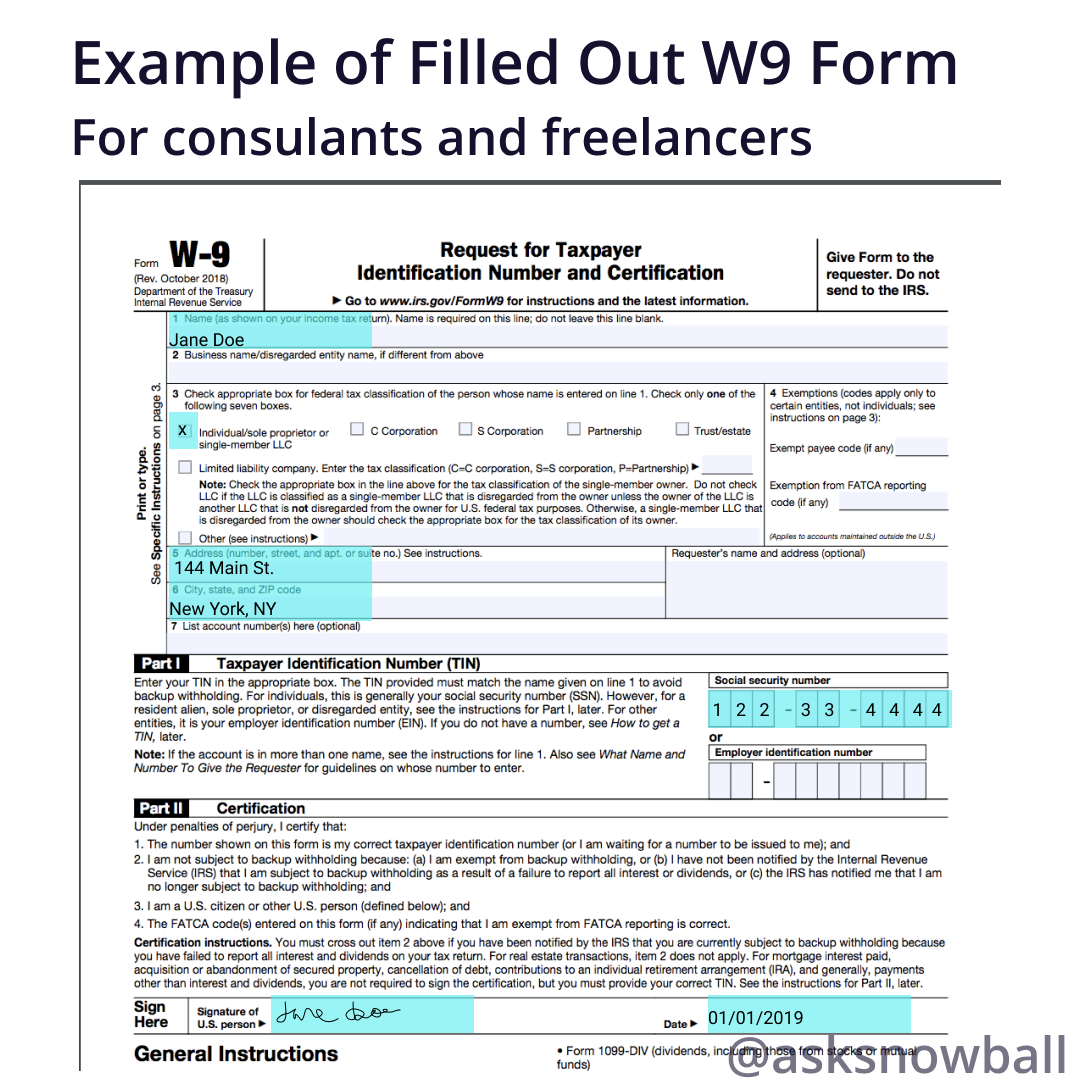

How To Fill Out A W 9 19

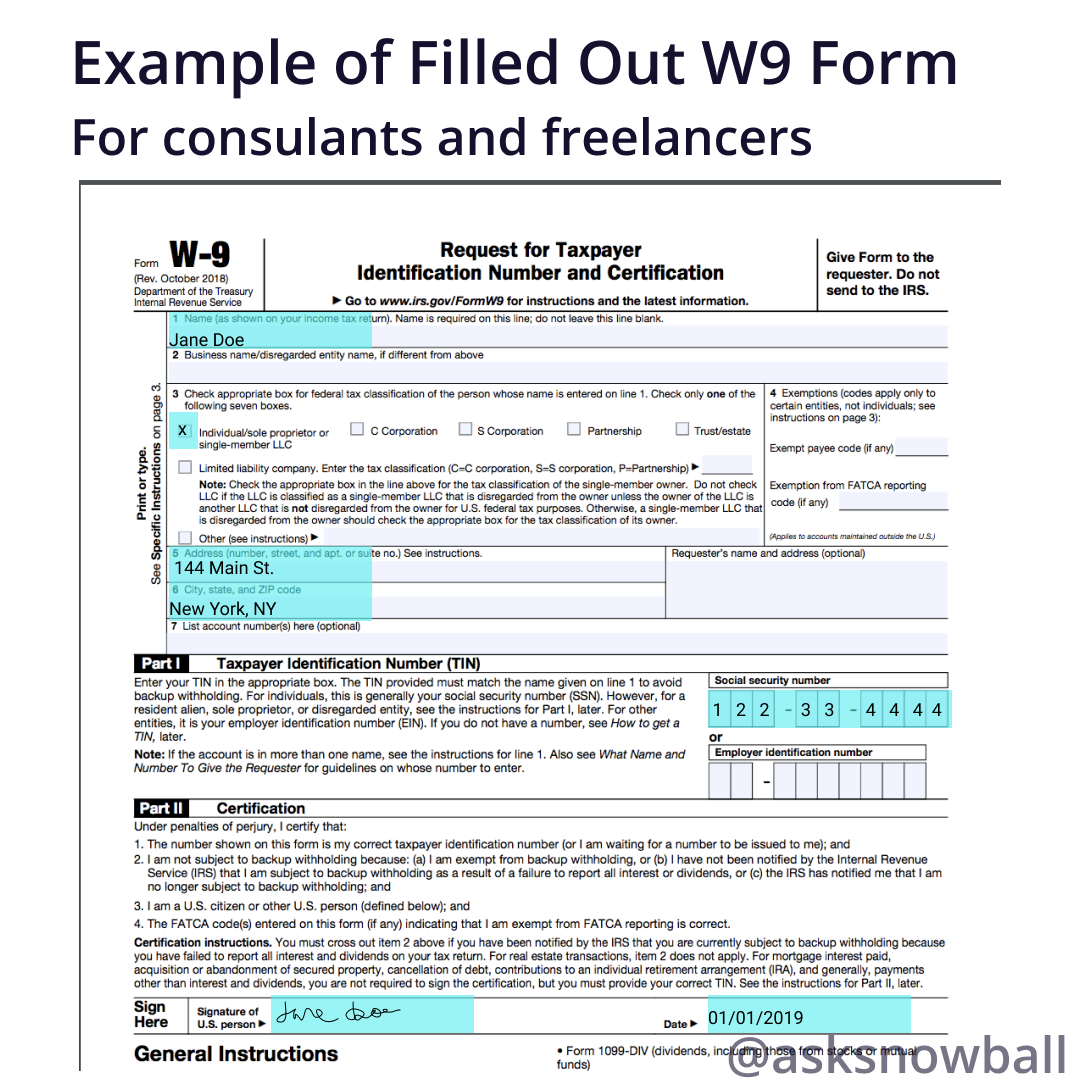

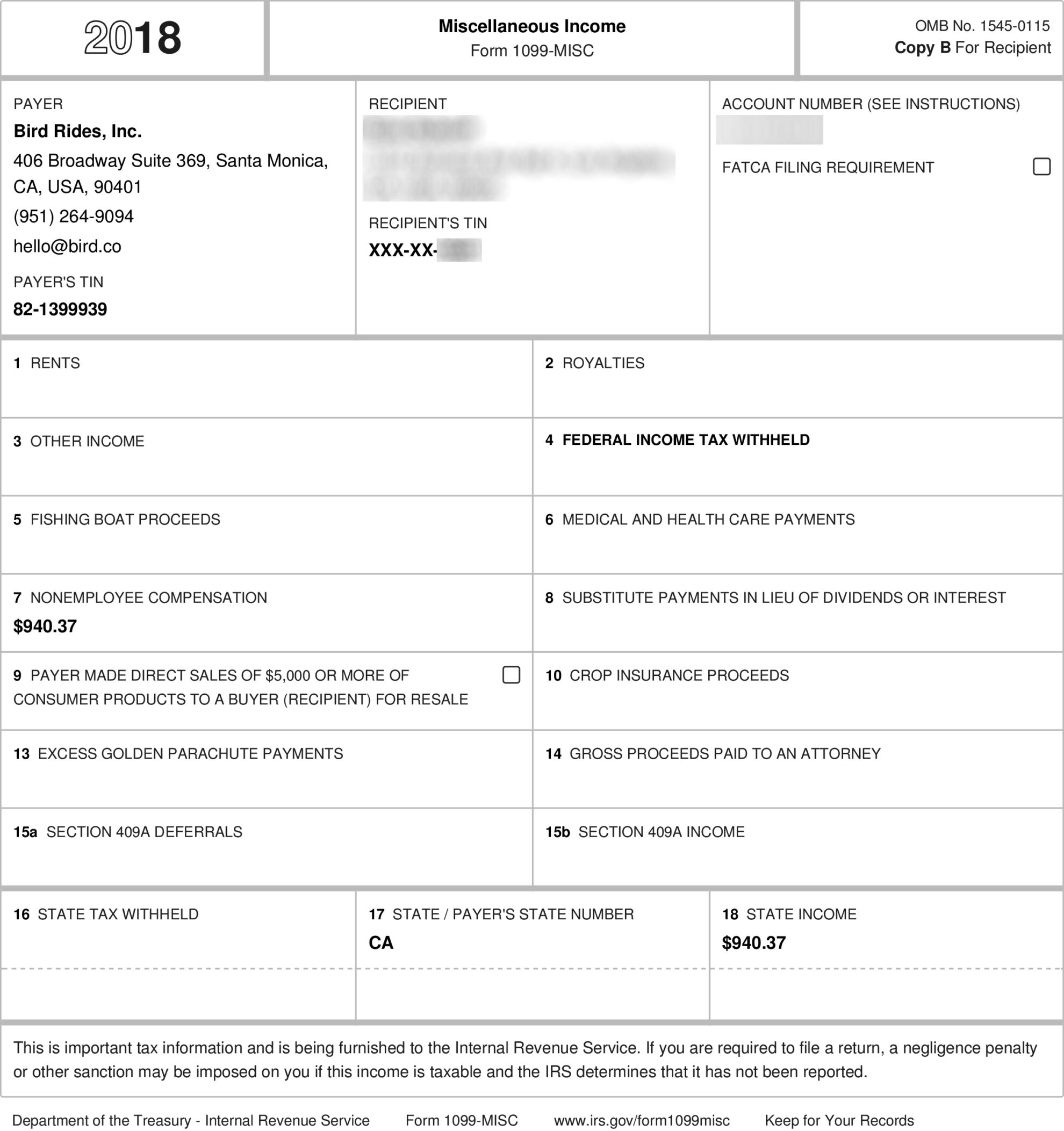

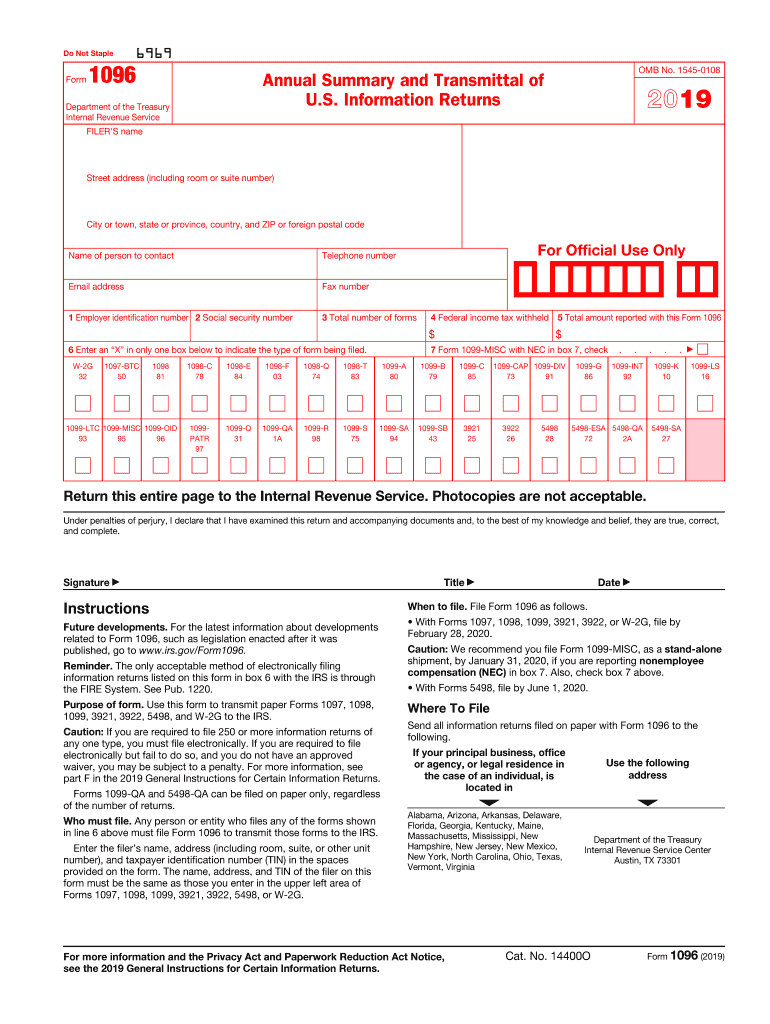

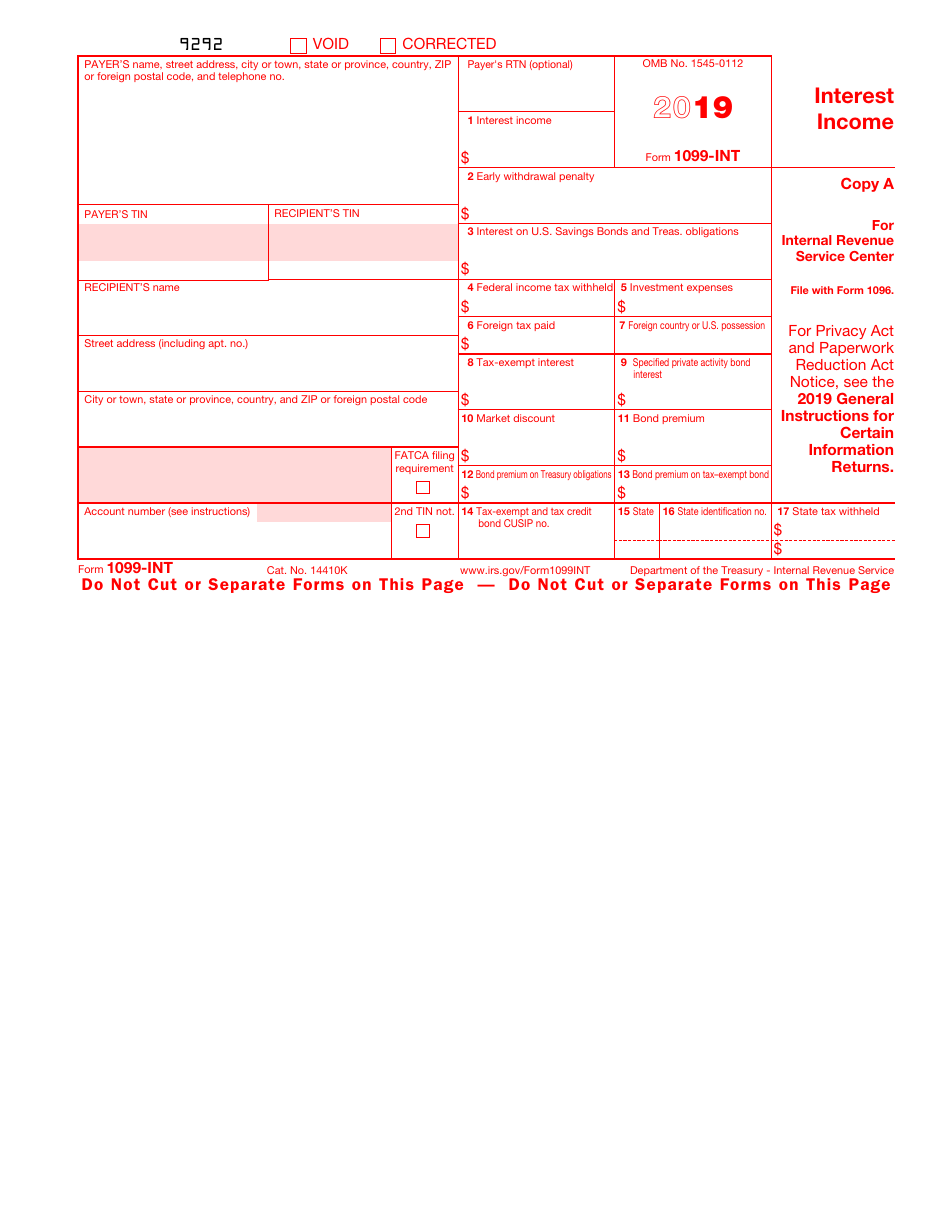

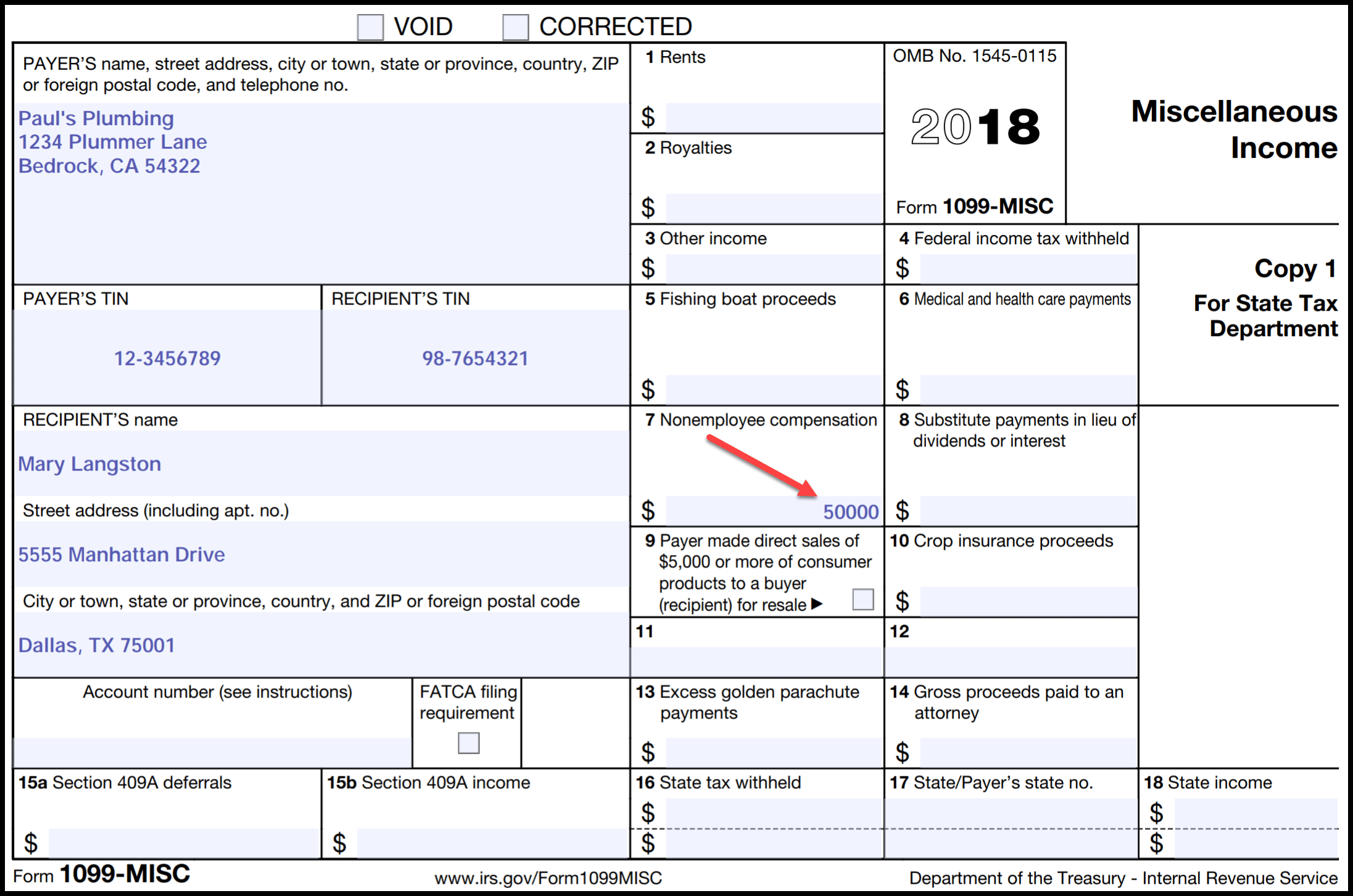

19 1099 Form Independent Contractor – A 1099 Form is really a form of doc that helps you determine the earnings that you simply earned from various sources It's crucial to note there are many different types of taxpayers who might be needed to finish 1099 Form For Contractors 19 Others by Loha Leffon 1099 Form For Contractors 19 – A 1099Independent contractor tax form 19 1099 Contractor Form 19 Others by Loha Leffon 1099 Contractor Form 19 – A 1099 Form is a form of doc that can help you determine the income that you simply attained from various sources It is crucial to note there are many different types of taxpayers who may be needed to finish Recent Posts 1099 K Form 18 1099Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade The independent contractors need

1099 Form Independent Contractor 19 Sample Independent Contractor Agreement Form Independent Contractor Check Stub Template 1099 Form For Independent Contractors Adp 1099 Contractor Form Shares Share on Facebook Recent Post printable w2 form; 25 Little Known 1099 Independent Contractor Deductions Don't sweat getting a form 1099MISC Here we will do a dive deep into tax deductions other than your typical office supplies To shed some light and make itemizations a little less "taxing," Keeper Tax has compiled a quick summary of deductions you might qualify for, and should be sure to take, in order to1099 Form Independent Contractor Printable – One of the most important and fundamental paperwork you must have at all times is a 1099 form It is a form the IRS demands all companies to maintain It could be used by businesses as an effective method Recent Posts Form 1099 DIV 19 Fillable 1099 MISC Form 19 Form 1099 B Box 1d Example 1099 MISC Form Filled Out 18 1099

Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,Independent Contractor 1099 MISC Form – In general, any business that has paid at least $600 to some individual or any unincorporated organization which has obtained at least two payment amounts from that person or business should problem a 1099 Form to every person or business that has received a minimum of one of these payment quantities This form is utilized by the IRSTax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate If it goes in the wrong category it does not affect the bottom line If you also get a W2 for this

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

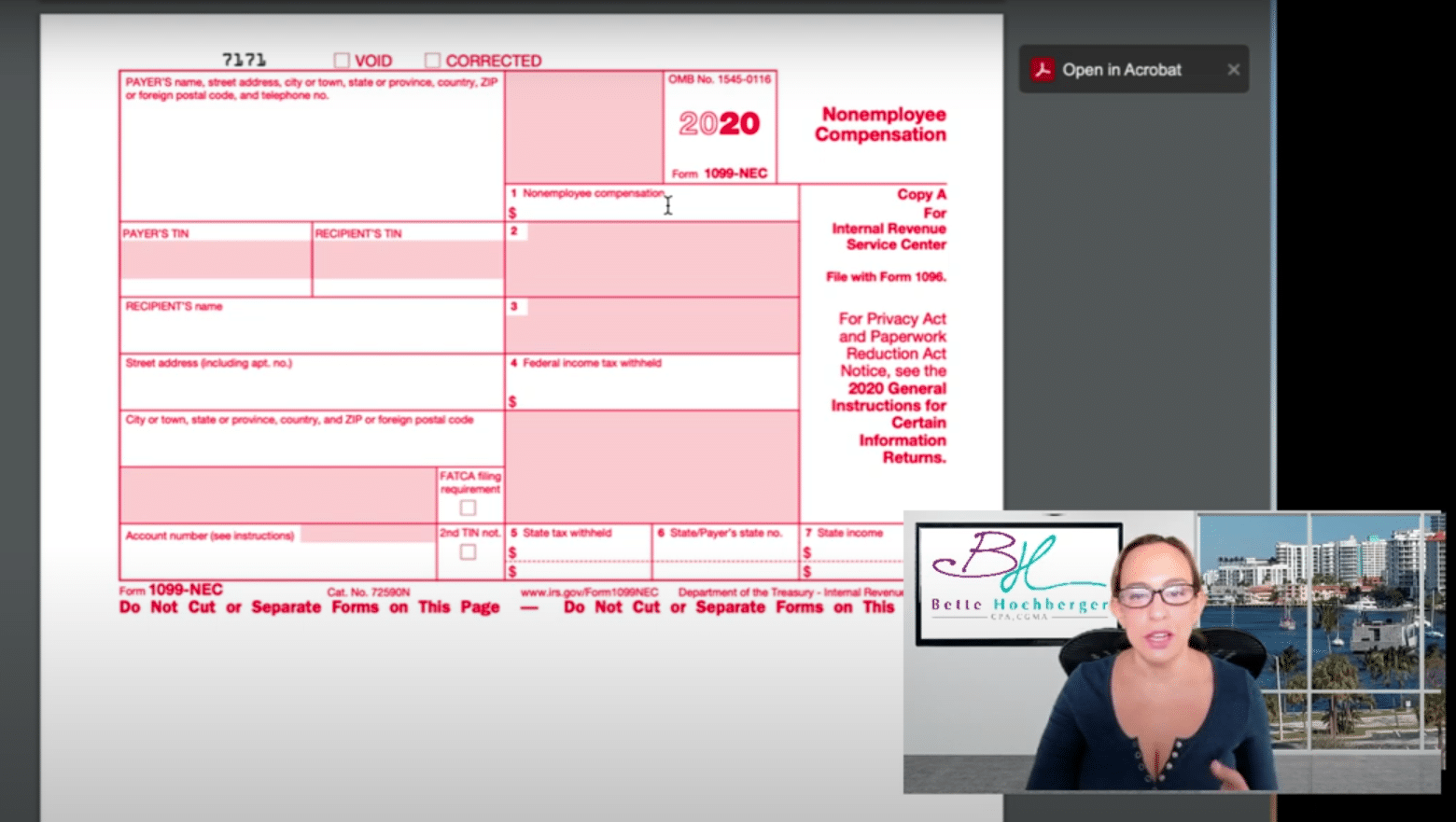

Independent Contractor Must Know About 1099 Tax Deductions If you earn money as an independent contractor, the IRS considers you as a "business of one" It is similar to a company that withholds the taxes automatically from the employee's paychecks; Printable 1099 Forms For Independent Contractors by Role Advertisement The IRS recently released draft Form 1099NEC (nonemployee compensation) For the 19 tax year, a business should continue to report nonemployee compensation on Form 1099MISC box 7 The

New Form 1099 Reporting Requirements For Atkg Llp

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Free collection Filing form 1099 MISC for your independent contractors free download from tax form 1099 professional with resolution 735 x 1102 pixel Printable Form 1099 Misc 16 1099 OID Original Issue Discount Rec Copy B Cut Sheet 400 Forms Pack Advisorselect 16 Year End Tax Reporting Information Other In e on Form 1040 What Is It Sending the 1099 Submission In e Tax Forms Whether you're a freelancer, independent contractor or a budding entrepreneur, you have access to several retirement plans While an IRA is always an option, Individual 401(k) and SEP IRAs can provide additional benefits for 1099 contractors 1099 Form For Independent Contractors by Role Advertisement

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

It S Irs 1099 Time Beware New Gig Form 1099 Nec

Form 1099MISC, Miscellaneous Income, is an Internal Revenue Service (IRS) form employers use to report nonemployee, business compensations paid Nonemployee taxpayers include selfemployed individuals, freelancers, sole proprietors, and independent contractors The federal tax agency requires businesses to file Form 1099MISC for each personPrintable 1099 form free ;Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application process

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Fill Out A W 9 19

If you work with independent contractors, you have to file a Form 1099MISC with the IRS at tax time Essentially, the 1099MISC is to contractors what the W2 is to employees It covers income amounts, while also indicating you haven't19 1099 Form Independent Contractor – A 1099 Form is really a form of doc that helps you determine the earnings that you simply earned from various sources It's crucial to note there are many different types of taxpayers who might be needed to finish a form of this character For example, if you function as an independent contractor for someone else, you would have to complete a form1099 Form For Independent Contractors kodyjohnston Templates No Comments 21 posts related to 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors Form For 1099 Contractors How To Fill Out A 1099 Form

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Tax Write Offs Business Tax Deductions

Free California Independent Contractor Agreement Word Pdf Eforms

As a result, those submitting a late 1099 form independent contractor 19 form alongside a 1099 form should take care to not mix the two up With this change, the IRS has taken a massive step toward streamlining the filing process for those who hire independent contractors Previously, the information reported in box 7 of the 1099 had a separate deadline from the restQuickBooks demonstration by http//wwwslcbookkeepingcom/ on how to set up 1099 contractors in QuickBooks In this QuickBooks video tip we will show you hoA list of job recommendations for the search 1099 form for independent contractor 19is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

/6757838321_ad13328b31_k-4718104a261042f388ed9ec6c762dca3.jpg)

Form 1099 Definition

The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary partiesHow to structure your finances as a 1099 contractor Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if their income (net earnings

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

My Employer Says I M An Independent Contractor Does L I Cover Me

1099MISC forms go to independent contractors, partnerships and other entities with whom you contract for services, among others The IRS has extensive guidance on who must send and receive a 1099 An independent contractor is selfemployed and receives 1099 forms from each client they did work for during the year An independent contractor fills out a W9 for their client For a sole proprietor, these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040 For a partner, these 1099 forms flow onto Schedule K of a1099 form independent contractor Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve documents using a legal electronic signature and share them by using email, fax or print them out download forms on your computer or mobile device Enhance your productivity with powerful

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Independent Contractor 1099 For 19 › paying a contractor 1099 › 1099 form independent contractor download › 1099 application for contractors › 1099 contractor pdf Form 1099MISC & Independent Contractors Internal Top wwwirsgov Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee Independent contractor tax forms When tax time rolls around, if you earned $400 or more during the year, you'll need to file a tax return using the forms listed below In some situations, you might also be required to file a tax return even if your net income was less than $400 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form 1099 Form For Independent Contractors 19 by Donatien Desrosiers 21 Posts Related to 1099 Form For Independent Contractors 19 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 Form 1099 Misc Independent Contractors Irs 1099 Forms For Independent Contractors Tax 1099 Forms For Independent Contractors Printable 1099 Forms For Independent

How To File Form 1099 Misc Online For 19 Tax Year Youtube

1099 Misc Form Fillable Printable Download Free Instructions

1099 form independent contractor 21 Fill out documents electronically utilizing PDF or Word format Make them reusable by creating templates, include and fill out fillable fields Approve forms with a lawful electronic signature and share them via email, fax or print them out download forms on your PC or mobile device Enhance your efficiency with powerful service? The primary tax form received by an independent contractor is Form 1099MISC If you performed work for a person or business as an independent contractor, you will receive this form at the same time that employees receive W2 forms They usually arrive around the end of January following the tax yearForm 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due Date Form 1099 Reported Online to the IRS by the Payer or Issuer Issue a Form 1099 to a Payee, Contractor or the IRS

W 9 Vs 1099 Understanding The Difference

Do You Need To Issue A 1099 To Your Vendors Accountingprose

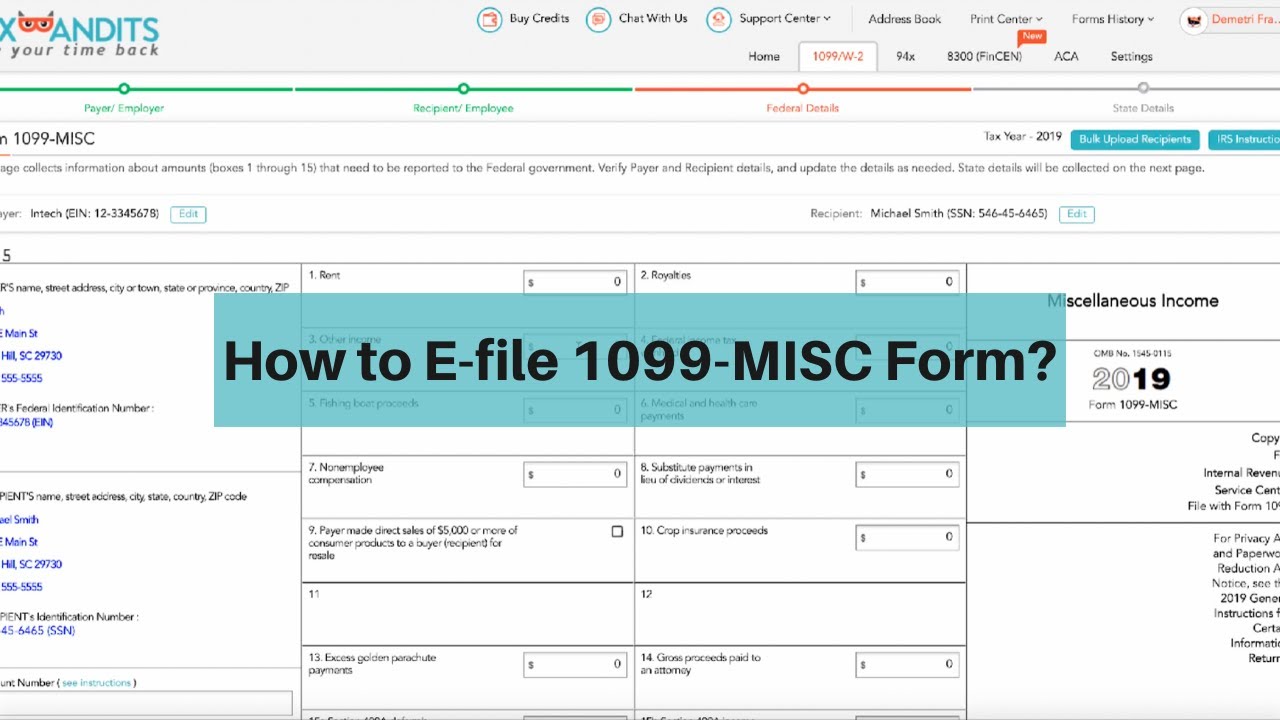

Independent Contractor and Statutory Employee You might be both an independent contractor and employee at the same time As a statutory employee, you will receive periodic paychecks and, for each tax year, a W2 from your employer(s) by January 31 of the following year If you also have independent contract income, that might be reported via one or more 1099 formsIndependent contractor tax form i9 Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1099MISC , steer clear of blunders along with furnish it in a timely mannerToby Mathis answers your questions during Tax Tuesdays a biweekly webinar event at 👉https//AndersonAdvisorscom/taxtuesdays *~ Claim Your FREE 45 min St

How To Deal With 1099 Misc Problems Mileiq

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

1099 form independent contractor 1099 form unemployment form 1099 instructions 1099 form 1099 form vs w2 can i print my own 1099 forms How to create an eSignature for the 1099 misc Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures How to make an electronic signature for the 19 Form 1099 by Role Advertisement Advertisement 21 Gallery of Irs 1099 Form Independent Contractor Irs Form 1099 Independent Contractor 1099 Independent Contractor Form Pdf Independent Contractor 1099 Tax Form Independent Contractor Form 1099 1099 Form Independent Contractor Form 1099 Form 15 Independent Contractor 1099 Form Independent Contractor 17 1099 Form IndependentGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

by Mathilde Émond 24 posts related to 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 1099 Agreement Form Choice Image Free Form Design Examples 1099 Form Independent Contractor Agreement Irs 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors Form For 1099Form 1099 is a government tax form that businesses use to report any money they've paid to individual contractors The only time you'll receive a 1099MISC form from a business is if that business paid you $600 or more in a tax yearFree fillable high school transcripts;

Irs Form 1099 K Payment Reporting Under California Ab 5

What Is A W 2 Form Turbotax Tax Tips Videos

Answer Although these forms are called information returns, they serve different functions Employers use Form W2, Wage and Tax Statement to Report wages, tips, and other compensation paid to an employee Report the

166 1099 Form Stock Photos Free Royalty Free 1099 Form Images Depositphotos

I Forgot To Send My Contractors A 1099 Misc Now What

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1099 Form 19 21 Fill Online Printable Fillable Blank Form 1099 Cap Com

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

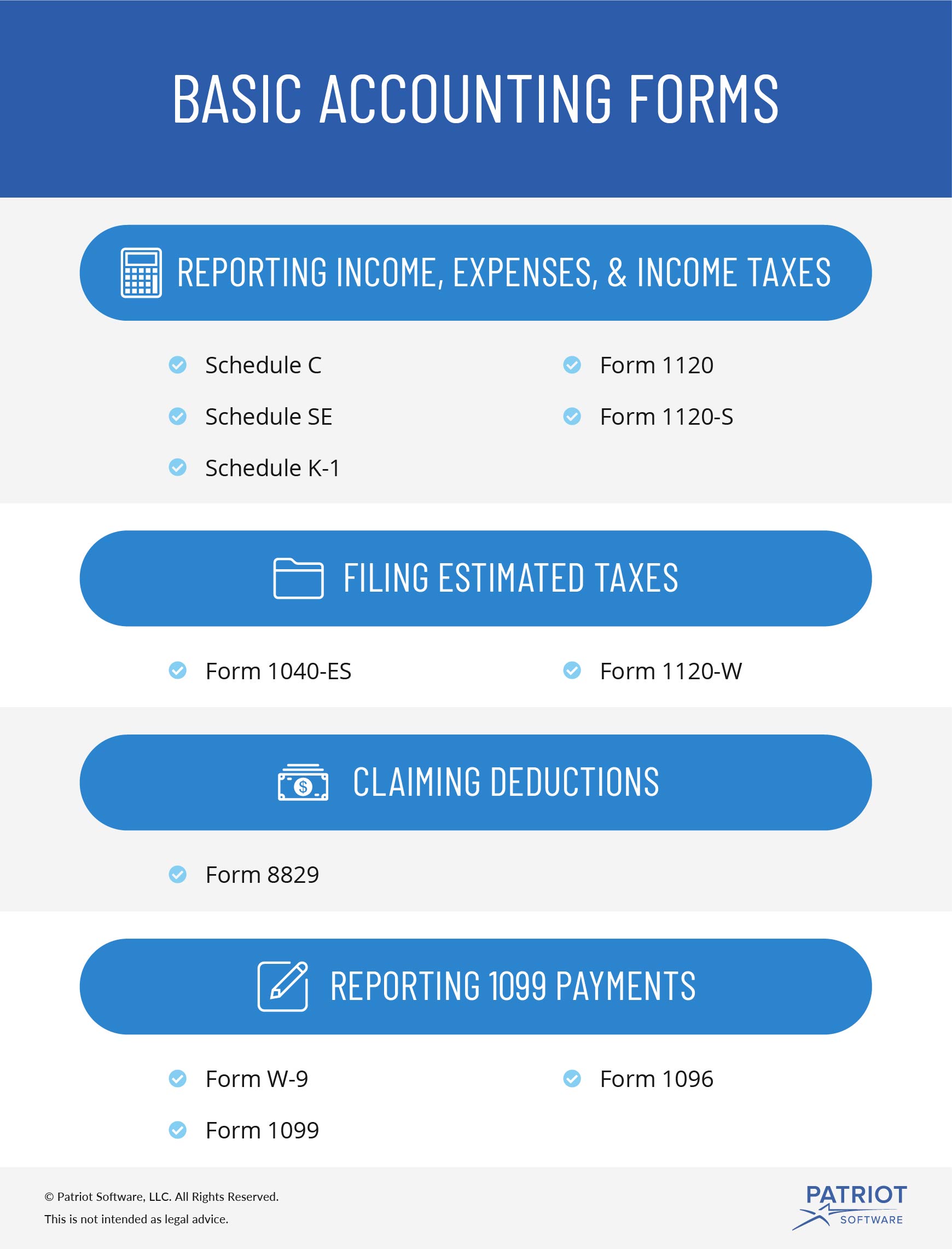

Basic Accounting Forms Irs Forms For Your Small Business

How To Report Misclassification Of Employees Top Class Actions

Www Uwyo Edu Wyocloud Files Docs Communications 3 21 19 Form 1099 Misc Box 7 With Travel Pdf

W 2 And W 4 A Simple Breakdown Bench Accounting

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Weaver Assurance Tax Advisory Firm

Www Irs Gov Pub Irs Prior I1099msc 19 Pdf

1099 Form 19 Pdf Fillable

Independent Contractor Taxes Guide 21

What Is Form 1099 Nec For Nonemployee Compensation

Time To Send Out 1099s What To Know

W2 Employee Versus 1099 Independent Contractor Compliance Checklist Liquid

Ultimate Tax Guide For Bird Lime Chargers Updated For 19

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

2

Irs 1099 Cap 19 21 Fill Out Tax Template Online Us Legal Forms

Irs 1096 Test Kw 19 21 Fill And Sign Printable Template Online Us Legal Forms

1

Fillable Form 1096 19 Edit Sign Download In Pdf Pdfrun

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Instant W2 Form Generator Create W2 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

1

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Abc Test Passed Into Law What Happens Now Solopoint Solutions Inc

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Learn How To Fill Out A W 9 Form Correctly And Completely

How To File Your Independent Contractor Returns Guide

1

1099 Form 19 Pdf Fillable

Andersen Com Uploads White Papers Various Federal Information Reporting Requirements And Considerations For The 19 Tax Year Pdf

Www Irs Gov Pub Irs Pdf I1099msc Pdf

Working With Independent Contractors Business Guidelines

1099 Misc Instructions And How To File Square

Tax Form Howtos Archives Bette Hochberger Cpa Cgma

Tax Update For Owner Operators And Fleet Owners Mission Financial

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Www Mdarochacpa Com Assets Uploads Eoyfiles19 19 form 1099 letter all filers Pdf

1099 Workers Vs W 2 Employees In California A Legal Guide 21

What Is The Difference Between Form 1099 Misc Vs Nec Taxbandits Youtube

I Received A Form 1099 Misc What Should I Do Godaddy Blog

36 Years Later New Non Employee Compensation Reporting Form September 10 19 Western Cpe

How To Read Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

Intro To Form 1099 Our Authority Part 2 By Moorish Science Temple Of America

Form Ssa 1099 19 1099 Form 21 Printable

F 1099 Misc

1099 Tax Misc Form Form 1099 Online E File 1099 Misc Form 19 By Form1099online Issuu

Tax Deadline Alert Forms W2 W3 1099 Misc Due By Jan 31 Cpa Practice Advisor

Filling Irs Form W 9 Editable Printable Blank Fill Out Or Print Irs Blank For Free

Didn T File My 19 1099 Form From Instacart I Don T Know If I Just File An Amended 19 Tax Return As A Independent Contractor And Wait Til Irs Approves My Taxes Before

Amazon Com 1099 Misc Forms 21 4 Part Tax Forms Kit 25 Vendor Kit Of Laser Forms Compatible With Quickbooks And Accounting Software 25 Self Seal Envelopes Included Office Products

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How Will The Tax Reform Affect W 2 And 1099 Tax Filings

Changes To 1099s In Altruic Advisors

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

1099 Workers Vs W 2 Employees In California A Legal Guide 21

What Are Information Returns Irs 1099 Tax Form Types Variants

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Filing Form 1099 Misc For Your Independent Contractors

19 Tax Forms When Should I Expect To Get Them The Motley Fool

Employee Versus Independent Contractor The Cpa Journal

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec

F 1099 Misc

Sap Business Bydesign Us 1099 Misc Tax Returns Sap Blogs

All That You Need To Know About Filing Form 1099 Misc Inman

Employee Versus Independent Contractor The Cpa Journal

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

W 9 Vs 1099 Understanding The Difference

What Is A 1099 Form H R Block

1099 Vs W2 Difference Between Independent Contractors Employees

0 件のコメント:

コメントを投稿