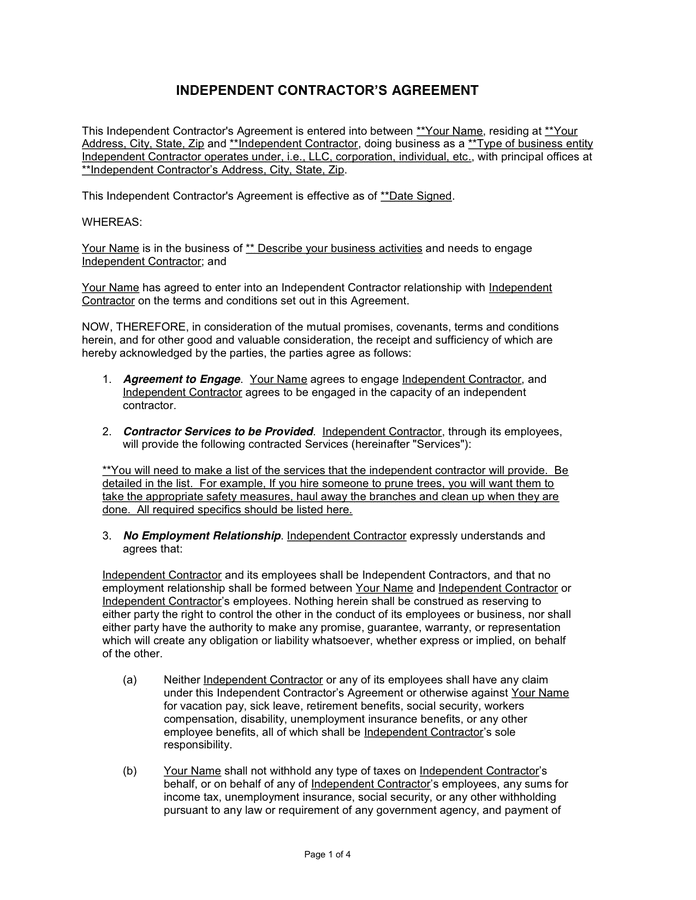

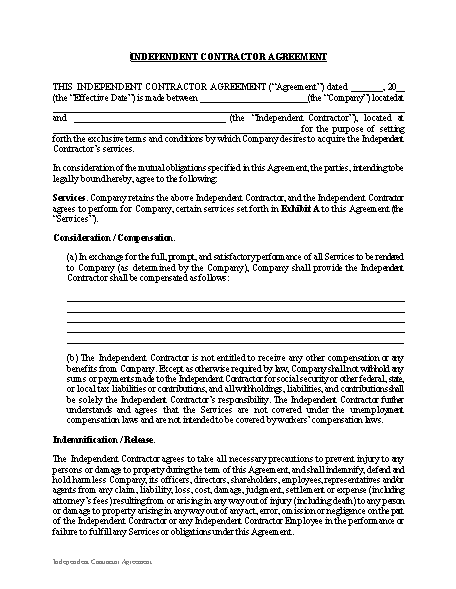

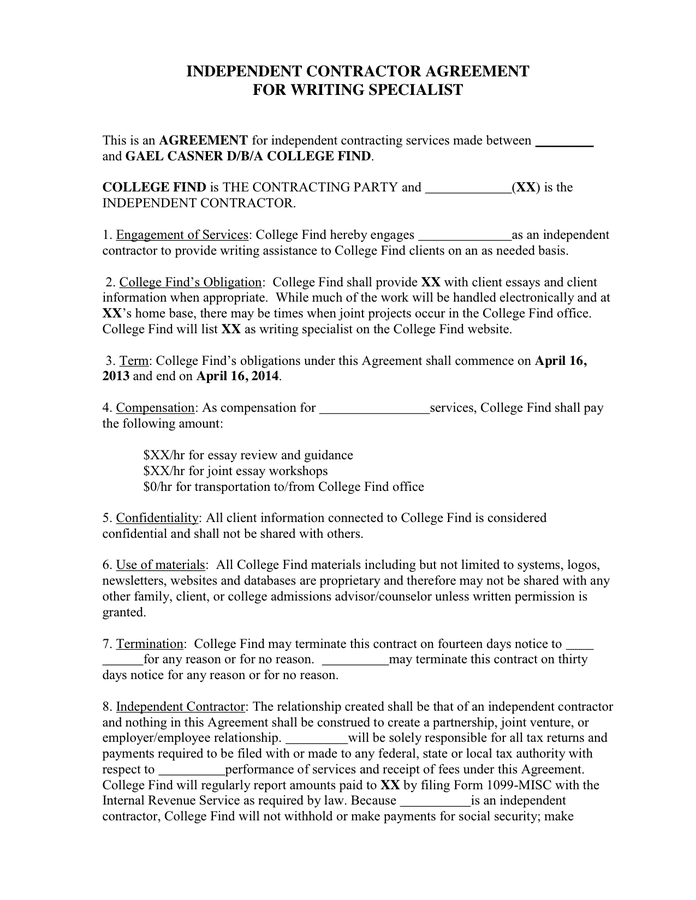

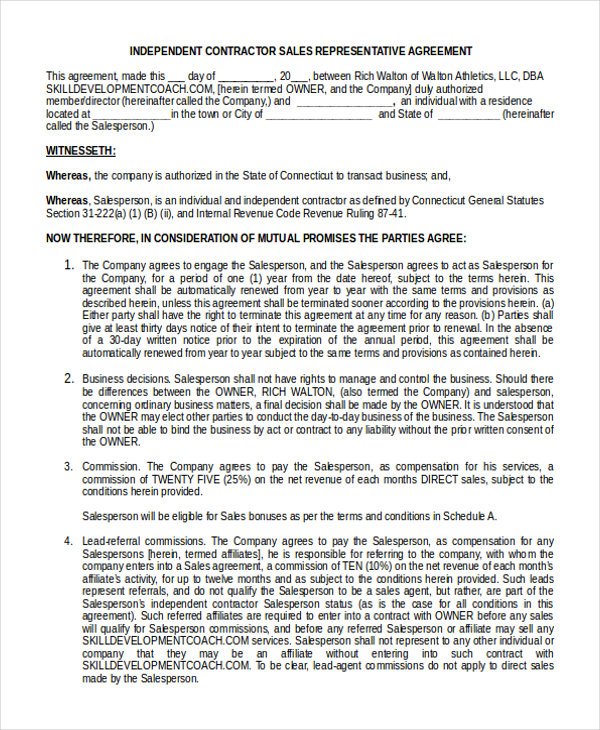

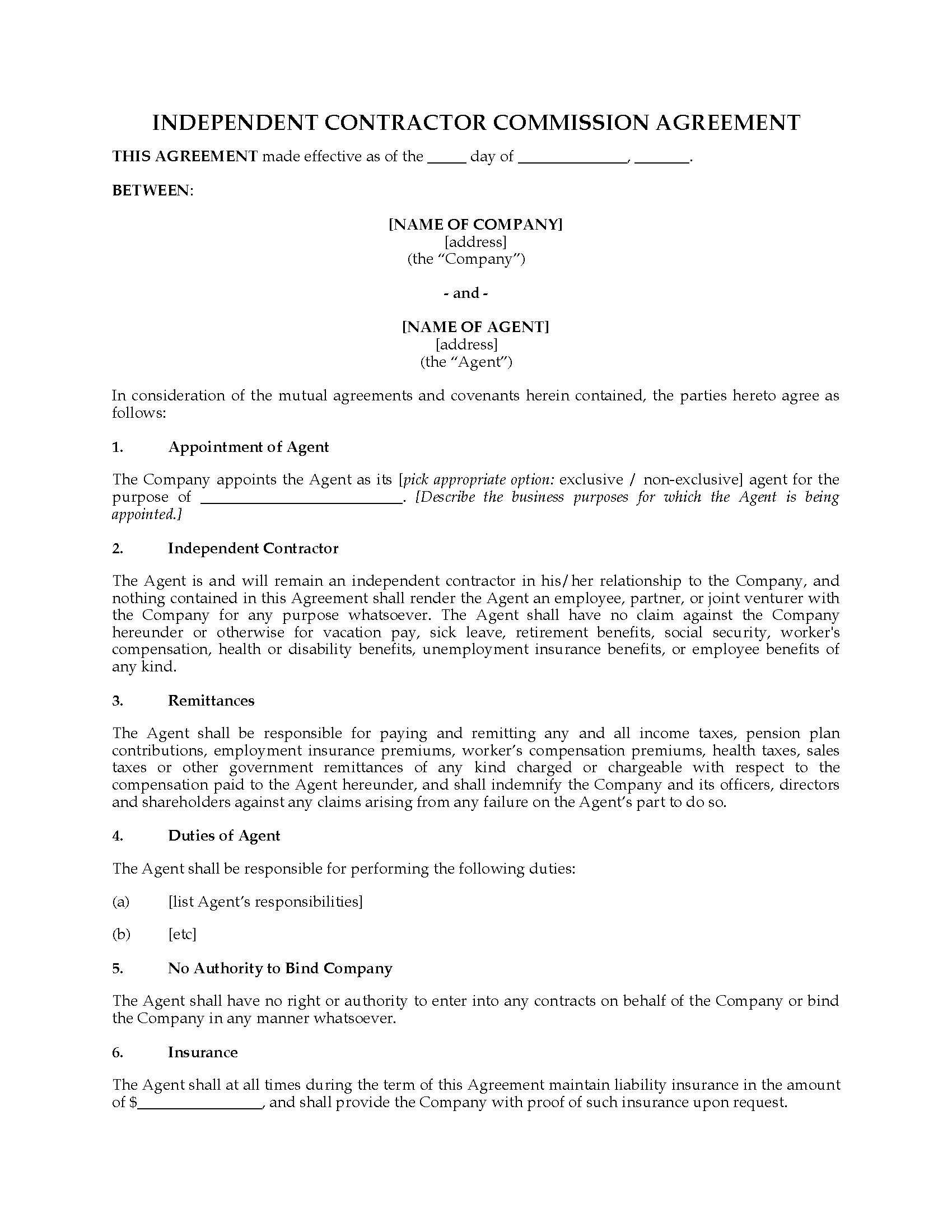

New IRS Rules for 1099 Independent Contractors Along with all the other changes we have dealt with in , the IRS has also changed how organizations report the money paid to independent contractors, or as they prefer to label it, Nonemployee Compensation In past years, if your organization paid a person for services who was NOT an employee, you may have neededSearch 1099 independent contractor jobs Get the right 1099 independent contractor job with company ratings & salaries 1,581 open jobs for 1099 independent contractorIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, Agreement Independent Contractor agrees that customers of the Company shall

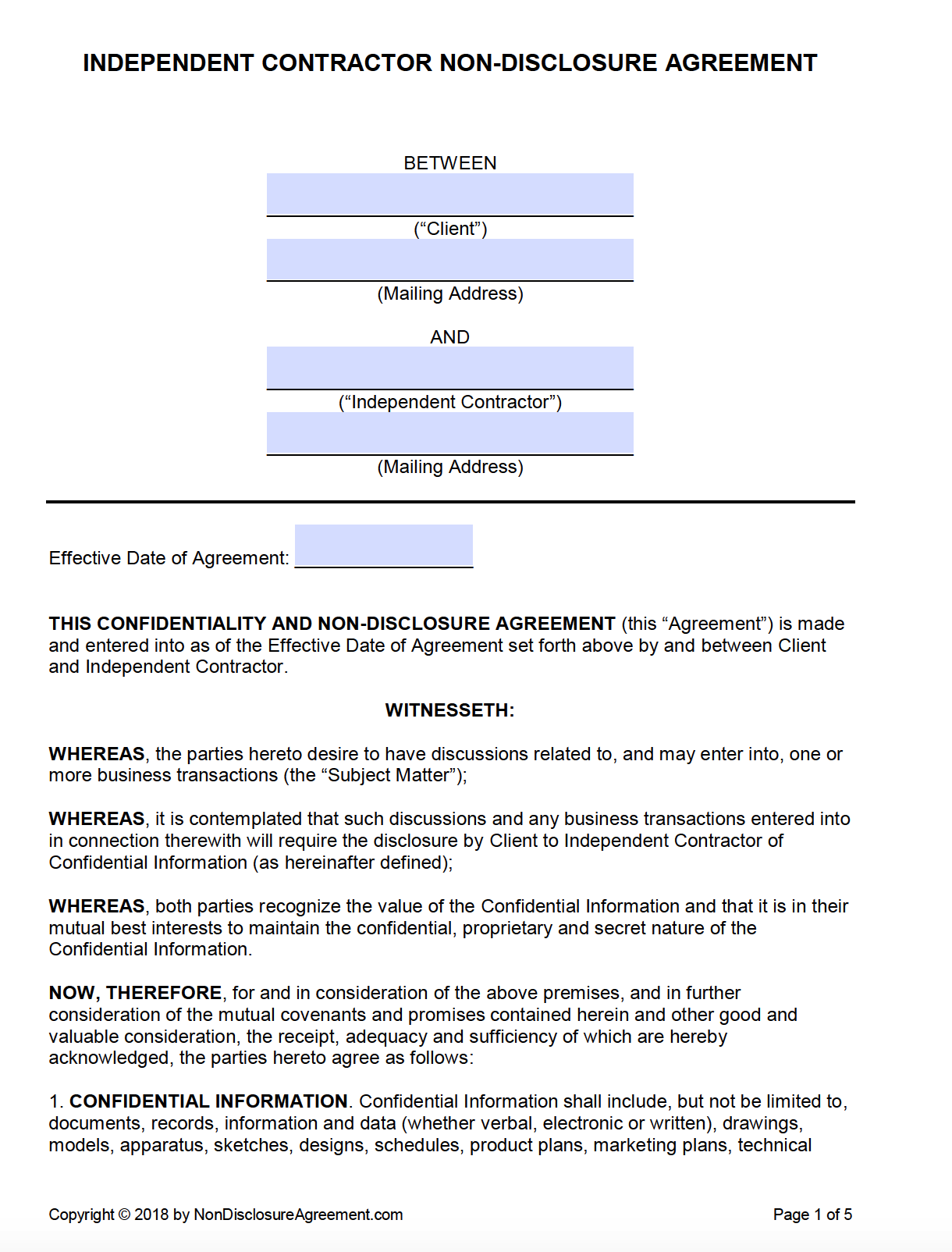

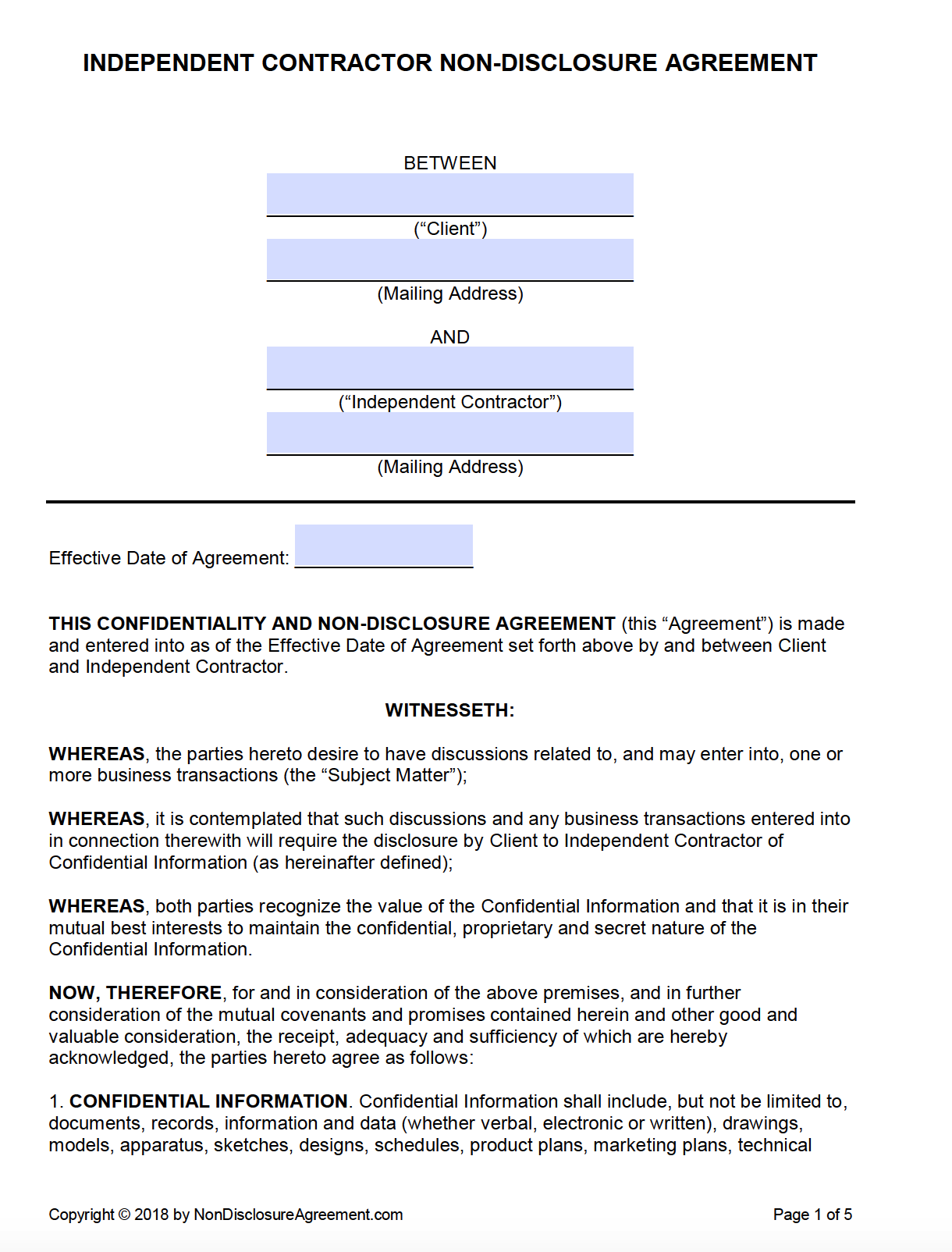

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

1099 contractor vs w2 contractor

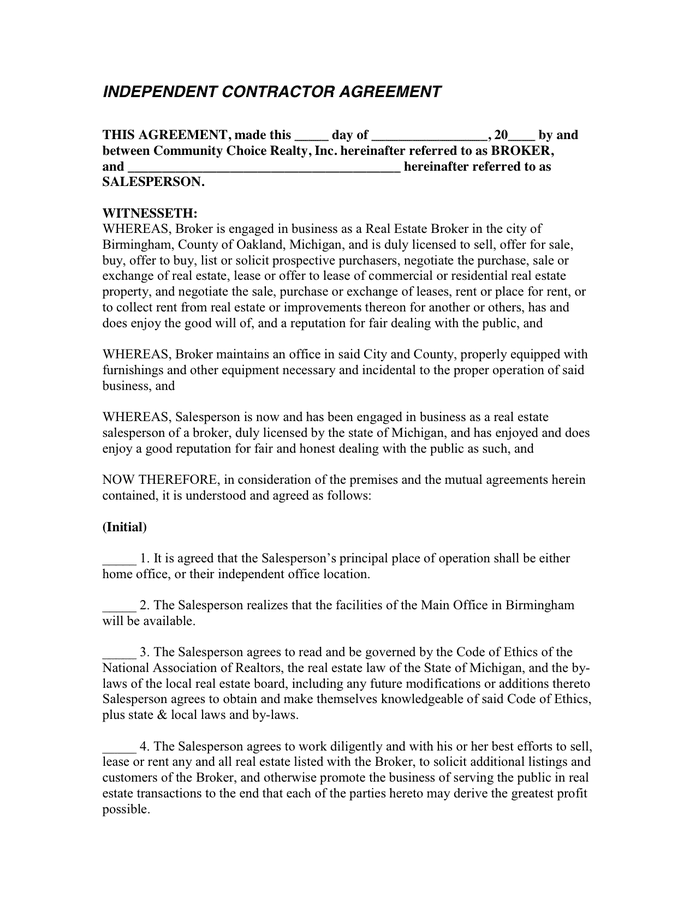

1099 contractor vs w2 contractor-No Being labeled an independent contractor, being required to sign an agreement stating that one is an independent contractor, or being paid as an independent contractor (that is, without payroll deductions and with income reported by an IRS Form 1099 rather than a W2), is not what determines employment statusContractor represents and warrants that Contractor and Contractor's employees and contract personnel will comply with all federal, state, and local laws requiring drivers and other licenses, business permits, and certificates required to carry out

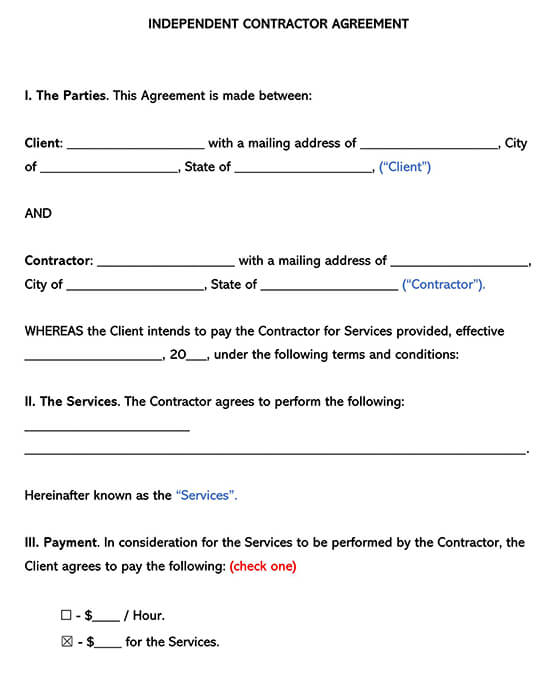

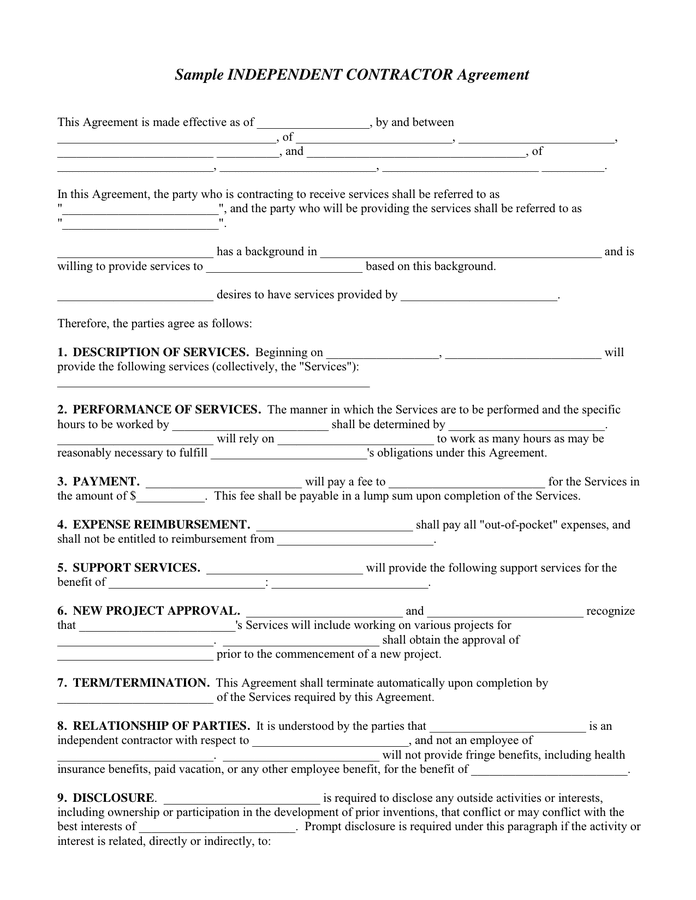

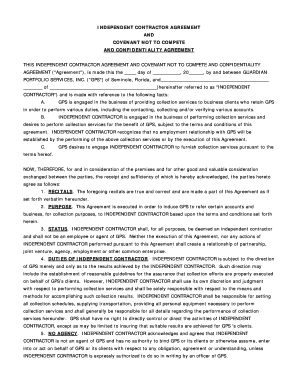

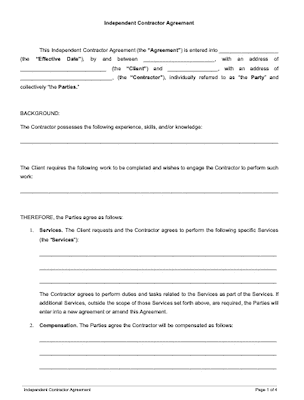

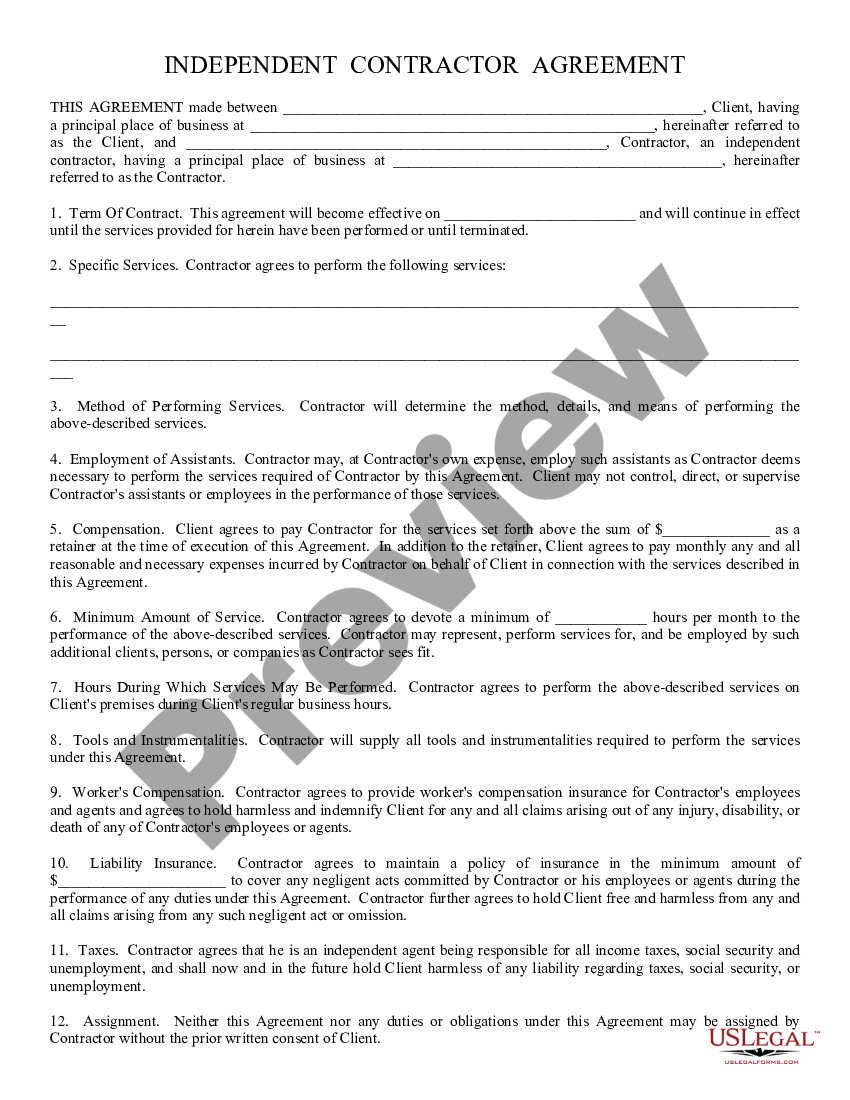

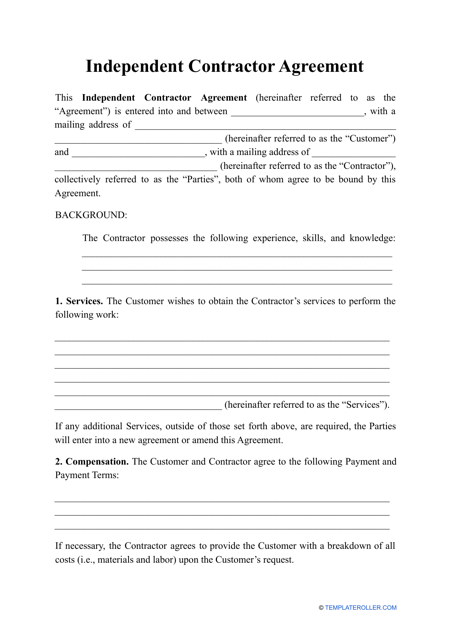

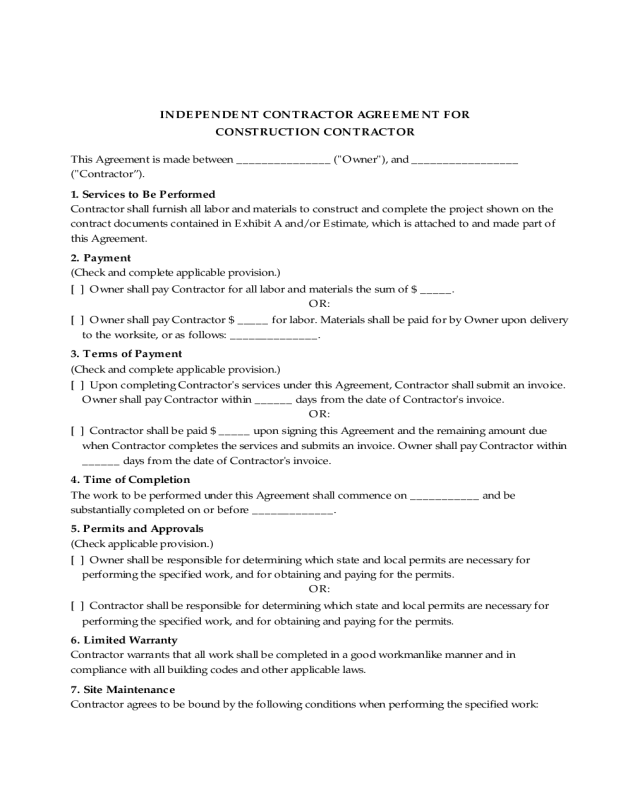

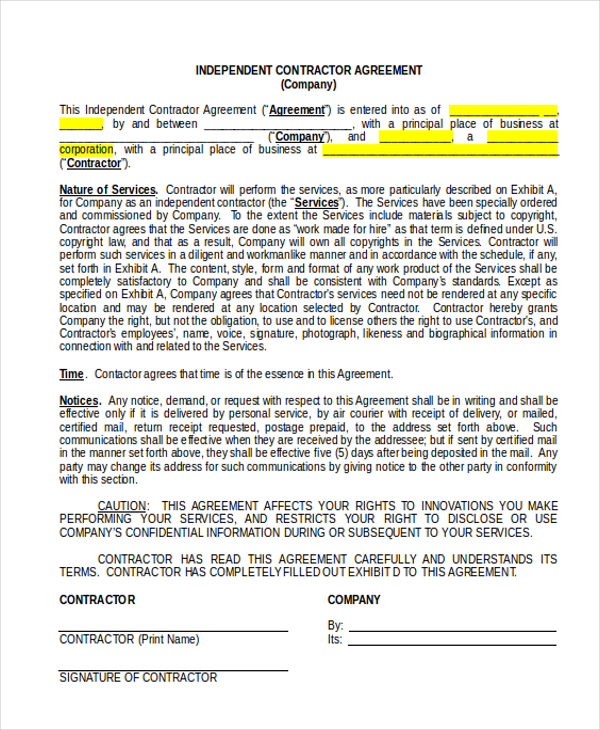

50 Free Independent Contractor Agreement Forms Templates

Tax deductions related to 1099 work are on top of the standard deduction in selfemployed contractors 1099 parttime work expenses It is always helpful to track 1099 work expenses even if you are working parttime For example, you rent an extra room in your house on Airbnb and earn an extra $4,000 from your total income of $40,000A 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service ( IRS ), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecksThe main difference between W2 employees and 1099 contractors is that 1099 contractors are hired for specific projects or tasks W2 employees have a fulltime job with the company, and benefits often come with that position Employers withhold income tax from federal, state, and local governments and other taxes from the employee's paycheck

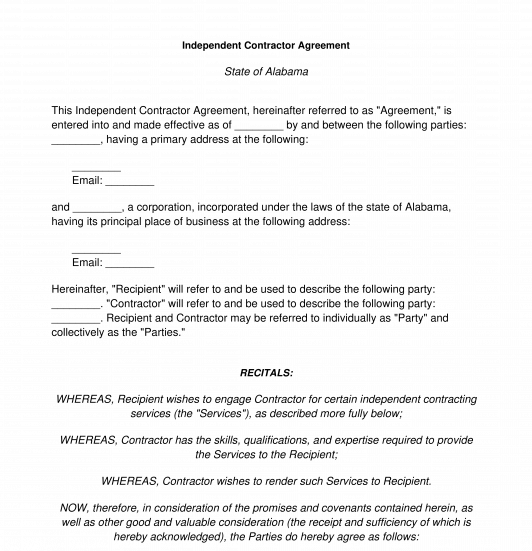

Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether theseMake sure you understand your business' requirements for covering workers, including independent contractors If your business is found to have workers that should have been reported for workers' compensation, your business will be held responsible for unpaid premiums with penalties and interest Is a 1099 form enough? An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreements

If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on UpCounsel's marketplace This is a guide for how to create, prepare, file and send 1099MISCs in QuickBooks Online As you wind down this year and gear up for the next, it's time once again to prepare 1099MISCs for your independent contractors to report their "nonemployee" compensation Check the IRS website for the latest deadlines1099 Independent Contractor Pay Stub Templates 123PayStubs offers a variety of professional 1099 pay stub templates for both the employees and contractors in different styles and designs You can choose from any pay stub samples to generate a pay stub for your 1099 contractors And the best part is all the paystub templates are free

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

50 Free Independent Contractor Agreement Forms Templates

In any case, the 1099MISC form has given rise to the term "1099 contractor" to describe a nonemployee who performs work for a company or another individual Please note that not every instance of a selfemployed individual rendering services triggers the need for a Independent contractors — often referred to as 1099 contractors for the relevant tax form — are business owners in their own right Even as sole proprietors with no employees, contractors offer services to businesses based on a contract In most cases, contractors have more than one client, and they set their own work hours 1099 Contractor 50/50 split Same $96,000 1099 gets $48,000 You get $48,000$19,0 (% for expenses) = $28,800 But, your expenses will not go up much, renting her/him space will be the same, so post $28,800 you may only have 10% in expenses

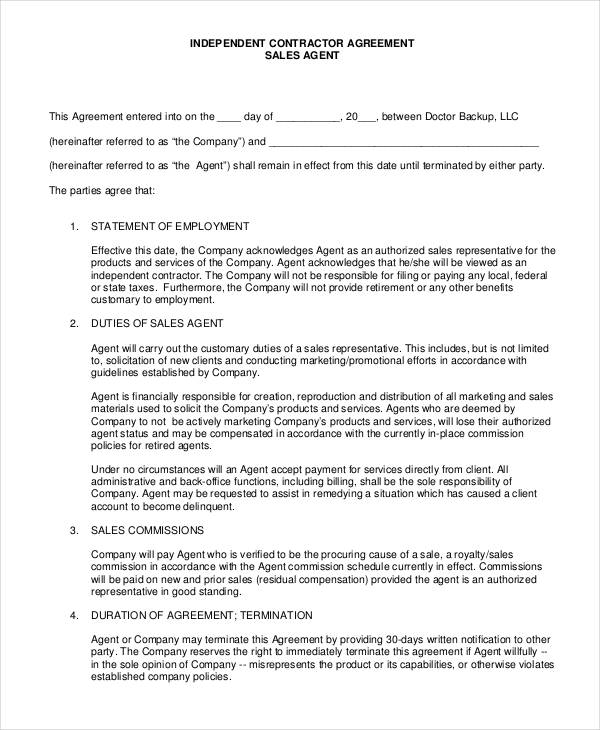

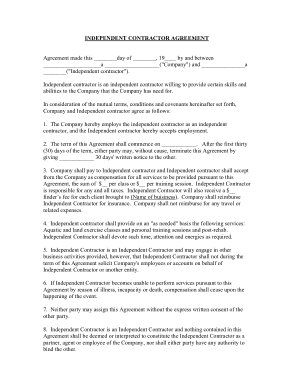

Independent Contractor Agreement

Independent Contractor Agreement 16 Free Pdf Google Docs Apple Pages Format Free Premium Templates

Manually sending Form 1099 Businesses that pay independent contractors more than $600 over the course of a year must provide the contractor with form 1099NEC come tax season Much like the W2 that is generated for an employee, the 1099 summarizes the financial exchange between a hiring business and the contractorThe Family and Medical Leave Act (FMLA) allows temporary workers to take leave if they meet certain criteria, but independent contractors are not eligible for it The contractor has the right to set rates, but a company can opt not to hire the contractor based Are 1099 Employees Eligible For Fmla?

Independent Contractor Agreement Template My Word Templates

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractors Generally, any payment in excess of $600 will require a Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)Push contractor payments at any time—no time constraints, deadlines, or fees Automate tax form generation & filing Branch collects relevant information at the time of onboarding, tracks cumulative contractor earnings through the Branch Wallet, and issues 1099NEC forms to you and your workers when necessary

Independent Contractor Agreement 2 Legalforms Org

The Ceo Legal Loft Shop Small Business Legal Resource

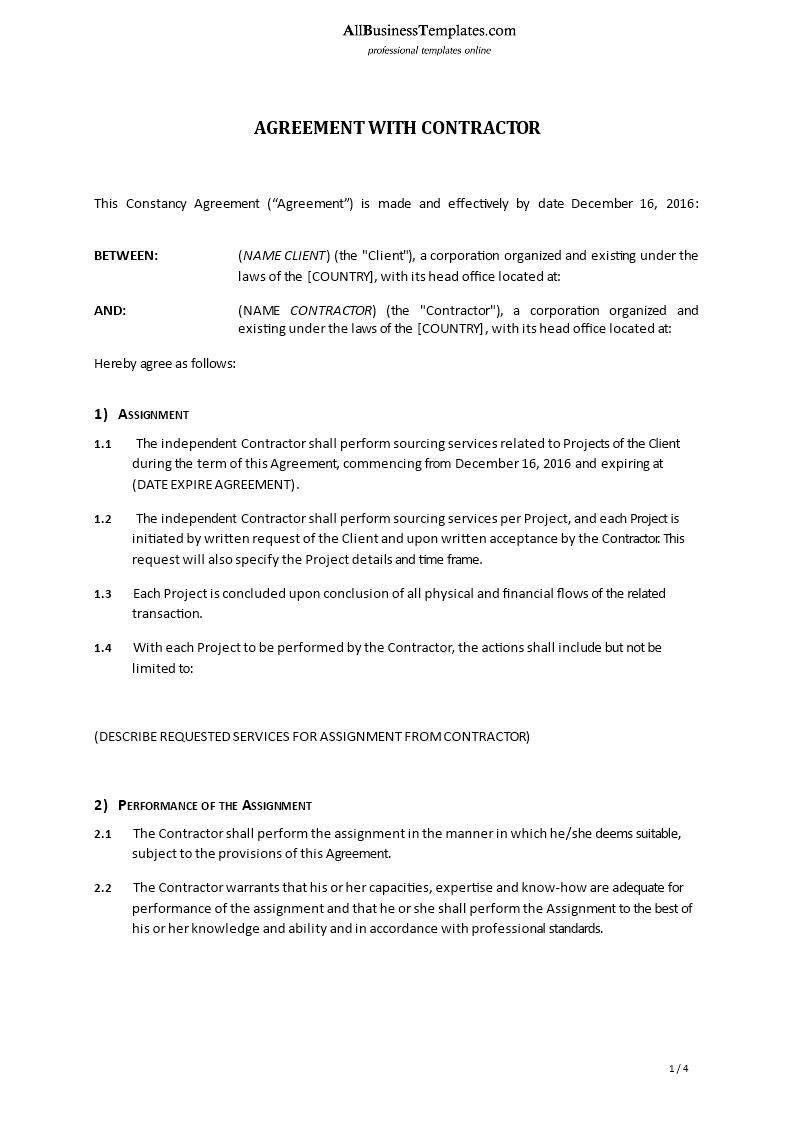

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Contractor Agreement, which are incorporated herein by reference DESCRIPTION OF SERVICES AND PROJECT MILESTONES The Services to be performed by Contractor are as followsThe IRS requires businesses to issue Form 1099MISCs to most noncorporate independent contractors or service providers – foreign or domestic – to whom they paid a minimum of $600 during the prior calendar year Does Canada have a 1099? If you're selfemployed or a freelancer, you likely get paid as an independent contractor rather than an employee The IRS defines an independent contractor as someone who performs work for someone else, while controlling the way in which the work is done In other words, someone pays you to perform a service or deliver a product, but they only have a say in

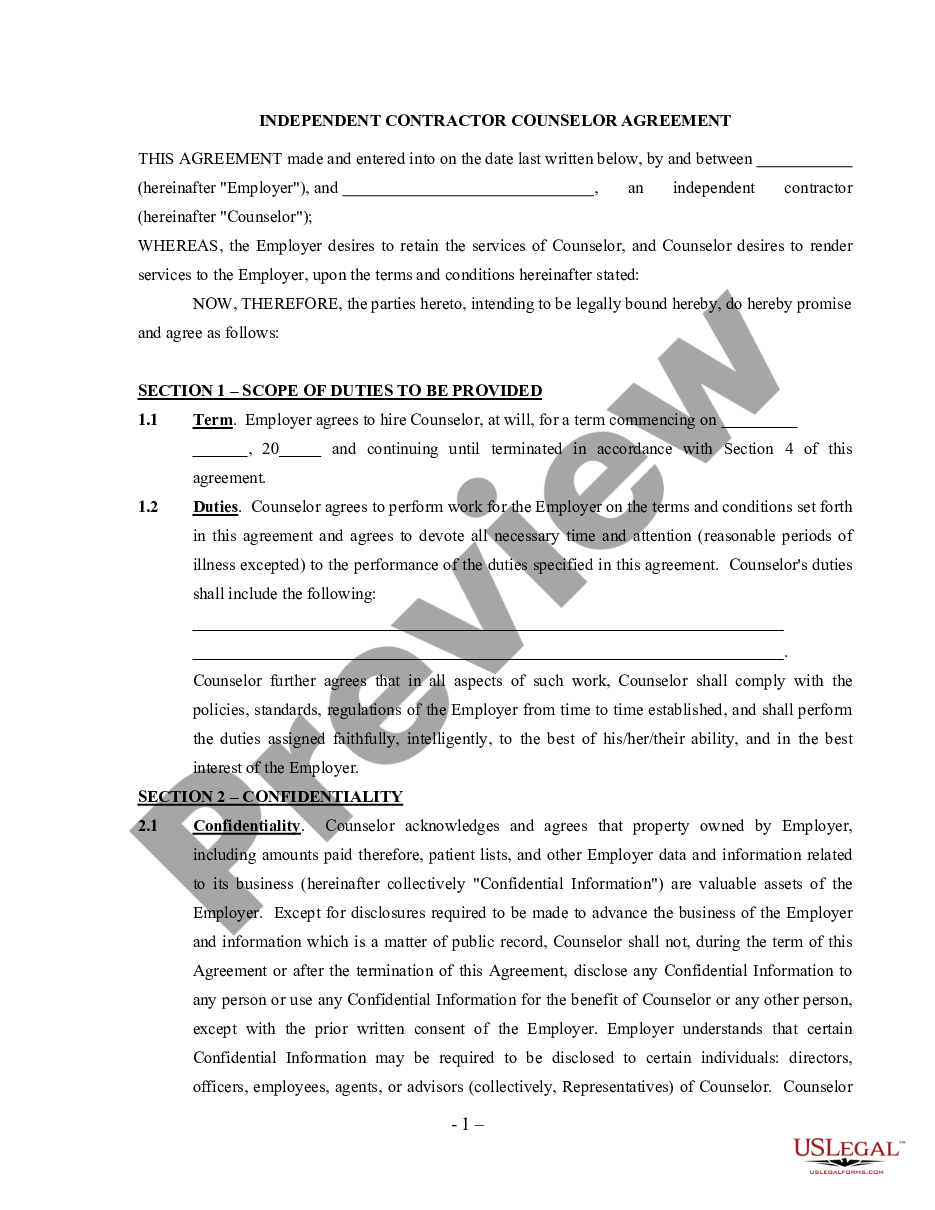

Counselor Agreement Self Employed Independent Contractor Mental Health Therapist Contract Agreement Us Legal Forms

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherINDEPENDENT CONTRACTORS IRS FACTOR TEST An independent contractor is a worker who individually contracts with an employer to provide specialized or requested services on an asneeded or project basis This individual is free from control and direction of the performance of their work, and the individual is customarily engagedContractor under another law (for example, tax law or state law), you may still be an employee under the FLSA Receiving a 1099 does not make you an independent contractor under the FLSA Signing an independent contractor agreement does not make you an independent contractor under the FLSA Whether you are paid by cash

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Independent Contractor Service Agreement In Word And Pdf Formats

A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like Contractors don't have to submit 1099 forms to the IRS, they are just meant for your records to confirm the income you received If your client never filed the form, you will not get in trouble for reporting (and paying taxes on) more income than was reflected on your 1099s You will pay taxes on that income just like any other earned incomeIndependent Contractor Engagement and Payment ClearPath's Agent of Record program lets you engage, pay, and manage your Independent Contractor 1099 workers, CorptoCorp, and subvendors under one central contract The result is an enterprisewide process with consolidated billing and minimal administration, delivering significant cost savings

Printable Blank

Free Texas Independent Contractor Agreement Pdf Word

What is a 1099 Contractor?In fact, a lot of people call the postrecession economy the 1099, or gig, economy You've probably hired a few of these independent 1099 contractors yourself to work on certain projects You obtained an written agreement from the worker acknowledging that s/he is an independent contractor (commonly referred to as a 1099 worker/employee) President Joe Biden's 22 budget plan released Friday highlighted his administration's commitment to employment protection to workers who have been classified as 1099 independent contractors The budget calls for the US Labor Department receiving $75 billion in the coming fiscal year to boost workerprotection efforts, including to root out

Create An Independent Contractor Agreement Download Print Pdf Word

Use A Nda With Independent Contractor Agreements Everynda

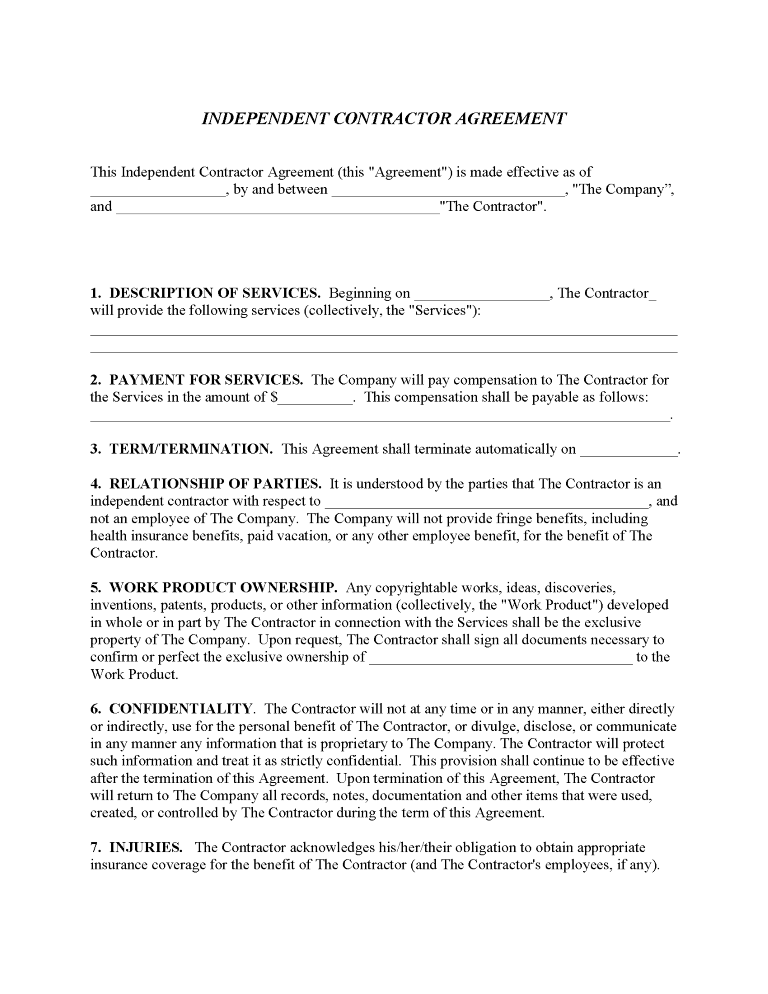

A '1099 contractor', also referred to as 'selfemployed' or an 'independent contractor', is a person who works independently This means that they they work for themselves, and not for an employer Usually, 1099 contractors are paid on a freelance basis They often work through a limited company or franchise, which they own themselvesThe independent contractor agreement must delineate the freelancers' duties as that of a 1099 employee, not a staff member If either party violates the contract, both parties have the right to seek legal action Termination rights If your contract doesn't include the termination conditions, your client could end the agreement without noticeWhen you hire a Canadian independent contractor, you do not need to submit a Form 1099NEC for them

Myusf Usfca Edu

Montana Independent Contractor Agreement Form Free Printable Legal Forms

Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,The biggest reason why filing a 1099MISC can catch people off guard is because of the 153% selfemployment tax The 1099 tax rate consists of two parts Form 1099 online helps to submit tax returns to the IRS conveniently and comfortably Also, File 1099 tax forms irrespective form device and time Our 24*7 filing service helps firsttime filers to fill out tax returns with ease That's the info about the Federal 1099 Tax Form for international contractors Start 1099 Filing Now

10 Must Haves In An Independent Contractor Agreement

Independent Contractor Agreement Template Contract The Legal Paige

THIS IS AN AGREEMENT FOR INDEPENDENT CONTRACTING SERVICES THE CONTRACTING PARTY PROVIDES NO BENEFITS SUCH AS UNEMPLOYMENT INSURANCE, HEALTH INSURANCE OR WORKER'S COMPENSATION INSURANCE TO INDEPENDENT CONTRACTOR CONTRACTING PARTY IS ONLY INTERESTED IN THE RESULTS OBTAINED BY THE

Independent Contractor Agreement Template Easy Legal Templates

Independent Contractor Agreement Template Free Pdf Sample Formswift

Free Independent Contractor Agreement For Download

Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement Template Approveme Free Contract Templates

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Create An Independent Contractor Agreement Download Print Pdf Word

Prima Independent Contractor Commission Agreement Online Business

Independent Contractor Agreement Full Time

Independent Contractor Agreement In Word And Pdf Formats

Free Independent Contractor Agreement Templates Word Pdf

Best Independent Contractor Agreement Documents Scribd

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Agreement Template Download Printable Pdf Templateroller

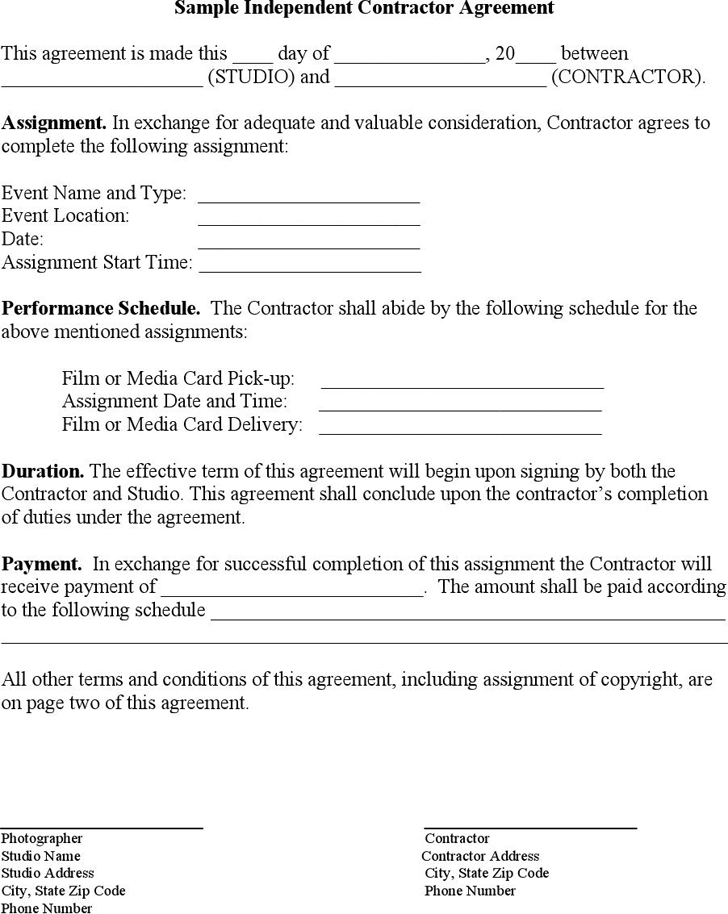

Sample Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

1099 Form Independent Contractor Free

50 Free Independent Contractor Agreement Forms Templates

1 Page Independent Contractor Agreement Form Template Free Download Free Pdf Books

Free Independent Contractor Agreement Free To Print Save Download

Independent Contractor Agreement Template Sample Best Word Pdf Download

Simple Independent Contractor Agreement Contractor Contract Contract Template Independent Contractor

Independent Contractor Agreement Simple Independent Contractor Contract Template Contractor Contract

Arizona Self Employed Independent Contractor Agreement Independent Contractor Agreement Arizona Us Legal Forms

3

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Independent Contractor Agreement Bestdox

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Independent Contractor Agreement Form Free Download

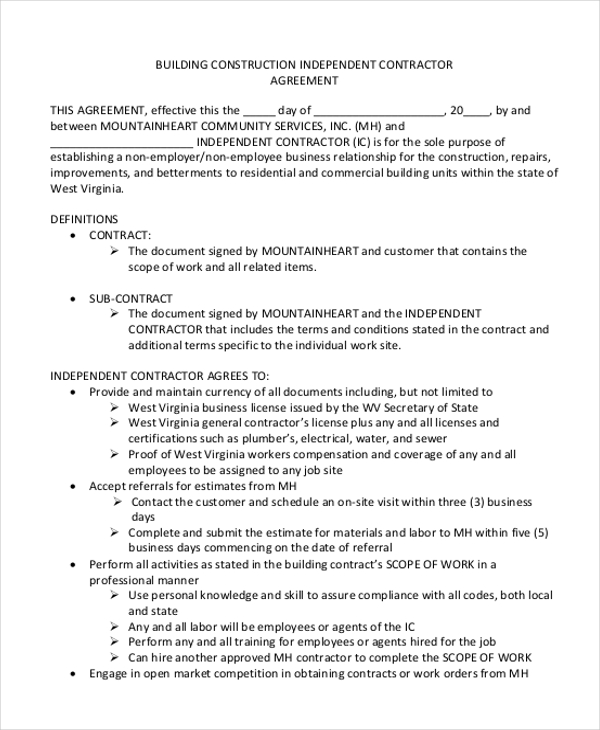

Independent Contractor Agreement For Construction Edit Fill Sign Online Handypdf

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Form Template Free Download Free Pdf Books

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Independent Contractor Agreement For Download

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Independent Contractor Agreement Modele Professionnel

Independent Contractor Agreements Free Printable Legal Forms

Independent Contractor Agreement In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Contract Template The Contract Shop

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Sample Template

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Commission Agreement Legal Forms And Business Templates Megadox Com

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Usa Independent Contractor Agreement For Real Estate Salesperson Legal Forms And Business Templates Megadox Com

Free Independent Contractor Agreement Pdf Word

Independent Contractor Agreement For Programming Services Template By Business In A Box

Independent Contractor Agreement Simple Pdf

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Agreement Template Download It Here

Independent Contractor Agreement For Construction Free Download

Free Independent Contractor Agreement Template Bonsai

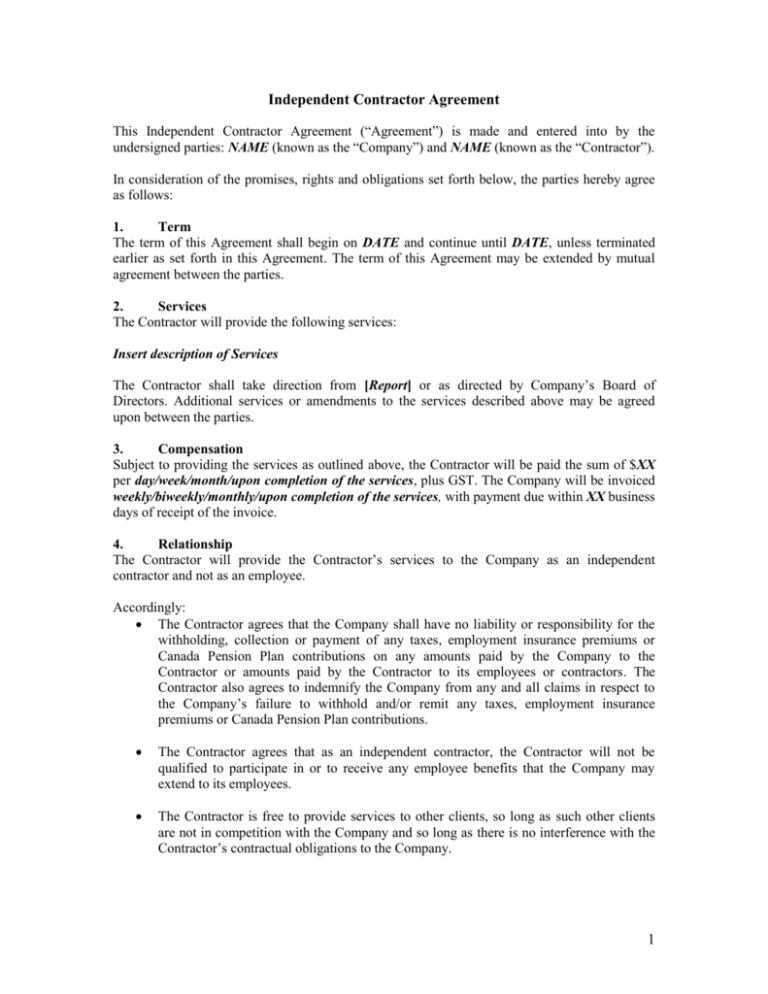

Ontario Independent Contractor Agreement Legal Forms And Business Templates Megadox Com

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Ne00 Independent Contractor Agreement Template English Namozaj

50 Free Independent Contractor Agreement Forms Templates

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S

Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Sample Independent Contractor Agreement

Independent Contractor Agreement Pdf Template Kdanmobile

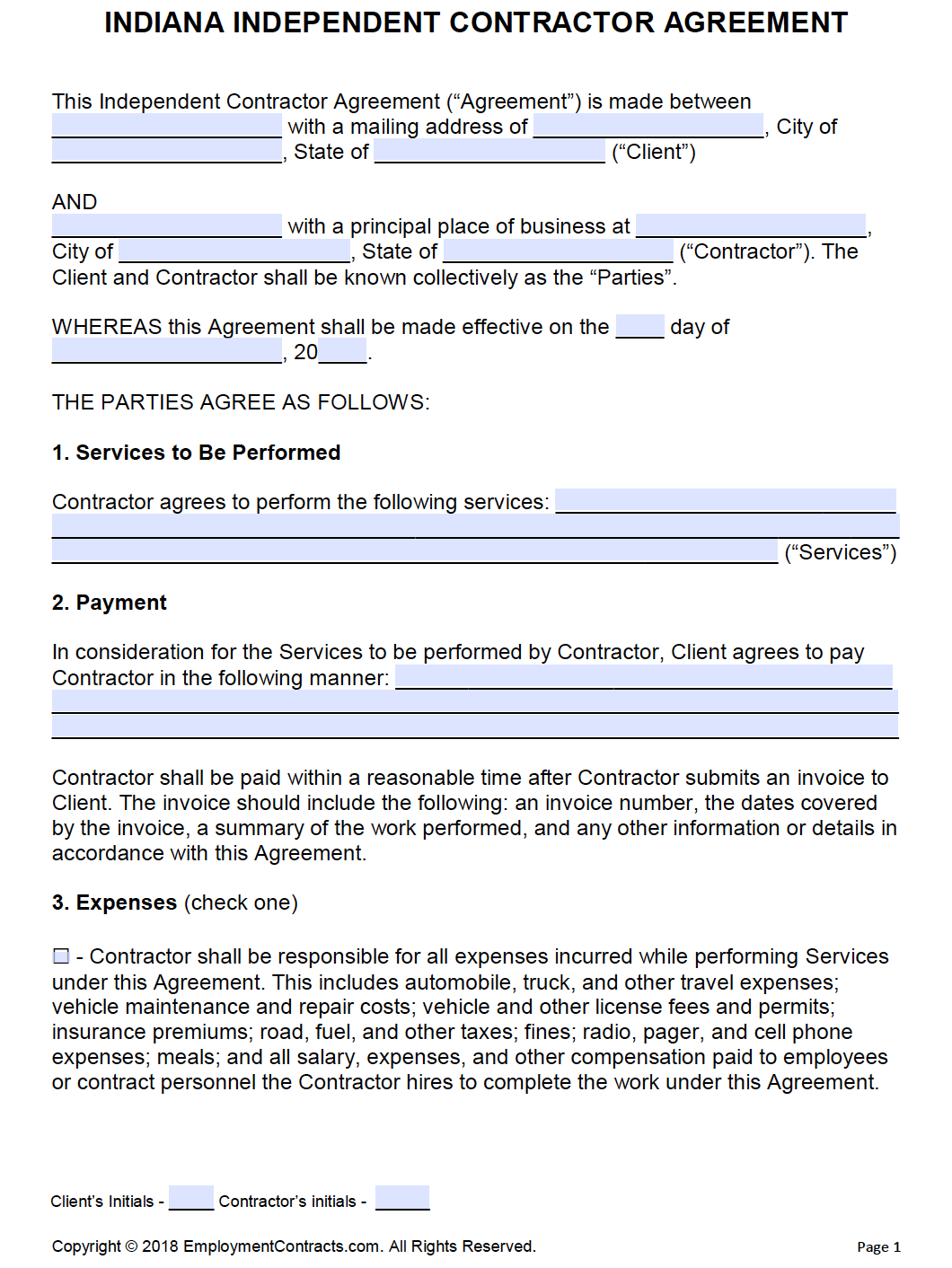

Free Indiana Independent Contractor Agreement Pdf Word

Independent Contractor Contract Template Awb Firm

Ct Gov

50 Free Independent Contractor Agreement Forms Templates

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Independent Contractor Agreement The Association Of Fitness Studios

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Hws Edu

Independent Contractor Agreement Creative Legally Fab

Free California Independent Contractor Agreement Word Pdf Eforms

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template What To Avoid

1099 Form Independent Contractor Agreement

Independent Contractor Agreement Programming Modele Professionnel

Independent Contractor Agreement Etsy

Contract For Services Independent Contractor Cipd Hr Inform

Independent Contractor Agreement Legalforms Org

Free Independent Contractor Agreement Template Download Wise

Independent Contractor Agreement This Independent

3

3

0 件のコメント:

コメントを投稿